Convertible Note Agreement Template

Understanding a Convertible Note Agreement

For startups and growing businesses seeking flexible financing options, a Convertible Note Agreement presents an attractive pathway to raise funds without immediately diluting ownership. This financial instrument is particularly appealing in the early stages of a company's lifecycle, where valuing the company can be challenging. It bridges the gap between the business's need for immediate capital and the investors' opportunity to participate in the company's future success.

A Convertible Note Agreement template is a vital resource for business owners, streamlining the process of drafting this complex financial document. It ensures that all legal and financial nuances are adequately covered, providing a solid foundation for both parties involved in the investment.

What is a Convertible Note Agreement Template?

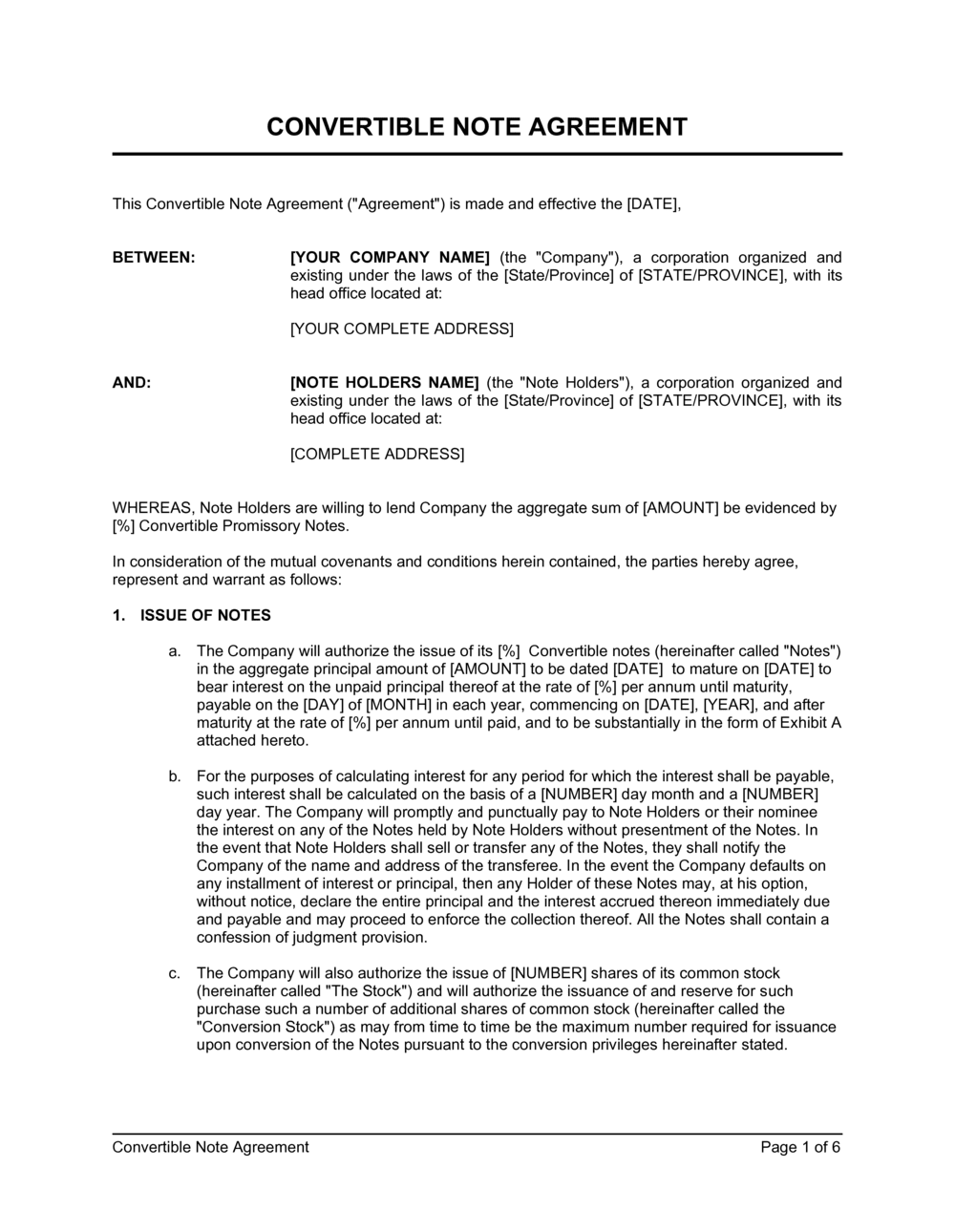

A Convertible Note Agreement template is a standardized document that outlines the terms under which an investor provides a loan to a startup or growth-stage company, with the intention that the loan will eventually convert into equity in the company. This template facilitates the negotiation process by providing a clear framework for the loan amount, interest rate, conversion mechanics, and maturity date, among other critical terms.

Key Elements of a Convertible Note Agreement Template

A well-structured Convertible Note Agreement Template should include several key components:- Loan Amount - The principal amount of the loan provided to the company.

- Interest Rate - Specifies the interest rate applied to the loan until conversion or repayment.

- Conversion Mechanics - This section details the conditions under which the note will convert into equity, including conversion triggers, valuation caps, and discount rates.

- Maturity Date - The date by which the note is expected to convert or be repaid.

- Valuation Cap - This cap sets the maximum valuation at which the note can convert into equity, protecting investors from dilution in subsequent financing rounds.

- Discount Rate - This rate provides early investors with a discount on the price per share at the time of conversion, acknowledging the additional risk they took by investing early.

- Repayment Terms - Outlines the circumstances under which the loan must be repaid, including scenarios where conversion is not triggered.

Related Documents for a Convertible Note Agreement

When drafting a Convertible Note Agreement, incorporating related documents can strengthen the legal and financial structure of the deal:

- Term Sheet - Summarizes the key financial and legal conditions of the investment.

- Rights Agreement - This agreement details the rights and privileges granted to shareholders, such as information rights and rights of first refusal.

- Subscription Agreement - A contract between the company and investors for the sale of the company's securities.

- Shareholders Agreement - This agreement outlines the rights and obligations of shareholders, including transfer restrictions, board composition, and dividend policies.

Why Use Business in a Box to Create a Convertible Note Agreement?

Business in a Box is the quintessential toolkit for business owners navigating the complexities of creating a Convertible Note Agreement, offering unparalleled benefits:

- Professionally Designed Templates - These templates were developed in collaboration with financial experts and legal professionals to ensure that your Convertible Note Agreements are comprehensive and comply with current regulations.

- Customizability - Allows you to tailor the agreement to fit the specific needs of your business and investment scenario, ensuring a perfect match for both parties.

- Efficiency - Saves valuable time by providing a ready-to-use template that simplifies the document creation process, allowing you to focus on securing your investment.

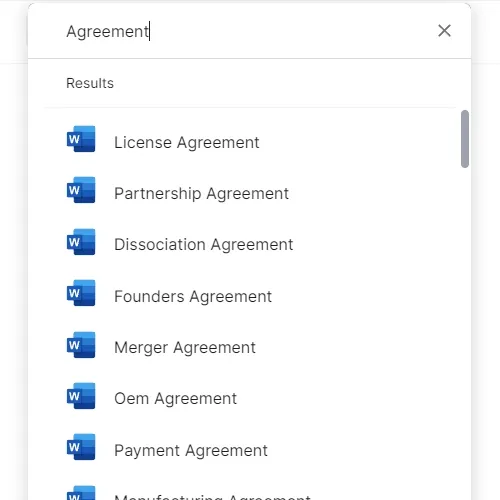

- Extensive Resource Library - Offers access to a broad spectrum of business and legal documents, supporting a wide array of needs beyond just financing agreements.

Leveraging Business in a Box for your Convertible Note Agreement template provides a professional, straightforward path to securing the financing your business needs, under terms that are clear, fair, and designed to support your company's growth trajectory.

Updated in April 2024

Reviewed on

Understanding a Convertible Note Agreement

For startups and growing businesses seeking flexible financing options, a Convertible Note Agreement presents an attractive pathway to raise funds without immediately diluting ownership. This financial instrument is particularly appealing in the early stages of a company's lifecycle, where valuing the company can be challenging. It bridges the gap between the business's need for immediate capital and the investors' opportunity to participate in the company's future success.

A Convertible Note Agreement template is a vital resource for business owners, streamlining the process of drafting this complex financial document. It ensures that all legal and financial nuances are adequately covered, providing a solid foundation for both parties involved in the investment.

What is a Convertible Note Agreement Template?

A Convertible Note Agreement template is a standardized document that outlines the terms under which an investor provides a loan to a startup or growth-stage company, with the intention that the loan will eventually convert into equity in the company. This template facilitates the negotiation process by providing a clear framework for the loan amount, interest rate, conversion mechanics, and maturity date, among other critical terms.

Key Elements of a Convertible Note Agreement Template

A well-structured Convertible Note Agreement Template should include several key components:- Loan Amount - The principal amount of the loan provided to the company.

- Interest Rate - Specifies the interest rate applied to the loan until conversion or repayment.

- Conversion Mechanics - This section details the conditions under which the note will convert into equity, including conversion triggers, valuation caps, and discount rates.

- Maturity Date - The date by which the note is expected to convert or be repaid.

- Valuation Cap - This cap sets the maximum valuation at which the note can convert into equity, protecting investors from dilution in subsequent financing rounds.

- Discount Rate - This rate provides early investors with a discount on the price per share at the time of conversion, acknowledging the additional risk they took by investing early.

- Repayment Terms - Outlines the circumstances under which the loan must be repaid, including scenarios where conversion is not triggered.

Related Documents for a Convertible Note Agreement

When drafting a Convertible Note Agreement, incorporating related documents can strengthen the legal and financial structure of the deal:

- Term Sheet - Summarizes the key financial and legal conditions of the investment.

- Rights Agreement - This agreement details the rights and privileges granted to shareholders, such as information rights and rights of first refusal.

- Subscription Agreement - A contract between the company and investors for the sale of the company's securities.

- Shareholders Agreement - This agreement outlines the rights and obligations of shareholders, including transfer restrictions, board composition, and dividend policies.

Why Use Business in a Box to Create a Convertible Note Agreement?

Business in a Box is the quintessential toolkit for business owners navigating the complexities of creating a Convertible Note Agreement, offering unparalleled benefits:

- Professionally Designed Templates - These templates were developed in collaboration with financial experts and legal professionals to ensure that your Convertible Note Agreements are comprehensive and comply with current regulations.

- Customizability - Allows you to tailor the agreement to fit the specific needs of your business and investment scenario, ensuring a perfect match for both parties.

- Efficiency - Saves valuable time by providing a ready-to-use template that simplifies the document creation process, allowing you to focus on securing your investment.

- Extensive Resource Library - Offers access to a broad spectrum of business and legal documents, supporting a wide array of needs beyond just financing agreements.

Leveraging Business in a Box for your Convertible Note Agreement template provides a professional, straightforward path to securing the financing your business needs, under terms that are clear, fair, and designed to support your company's growth trajectory.

Updated in April 2024

Easily Create Any Business Document You Need in Minutes.

Download or open template

Access over 3,000+ business and legal templates for any business task, project or initiative.

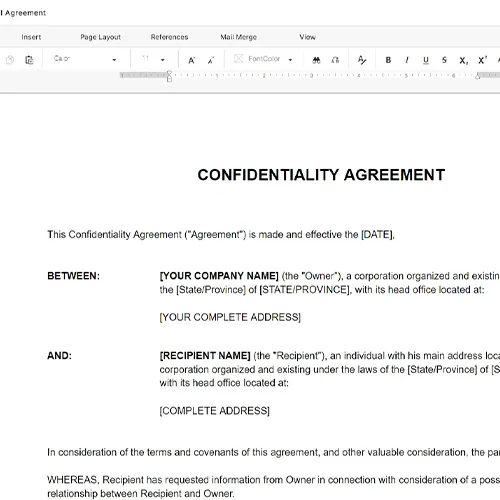

Edit and fill in the blanks

Customize your ready-made business document template and save it in the cloud.

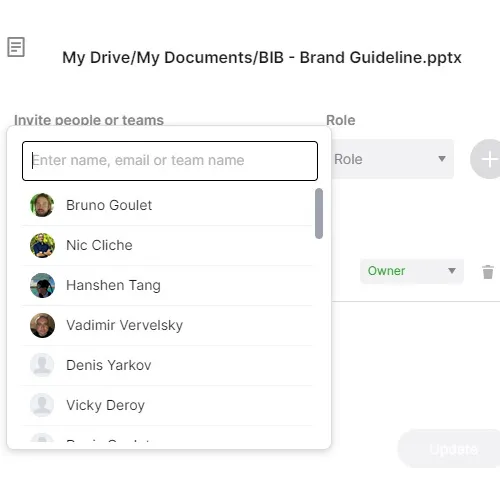

Save, Share, Export, or Sign

Share your files and folders with your team. Create a space of seamless collaboration.