Term Sheet Template

Crafting an Effective Term Sheet: Essential for Business Agreements

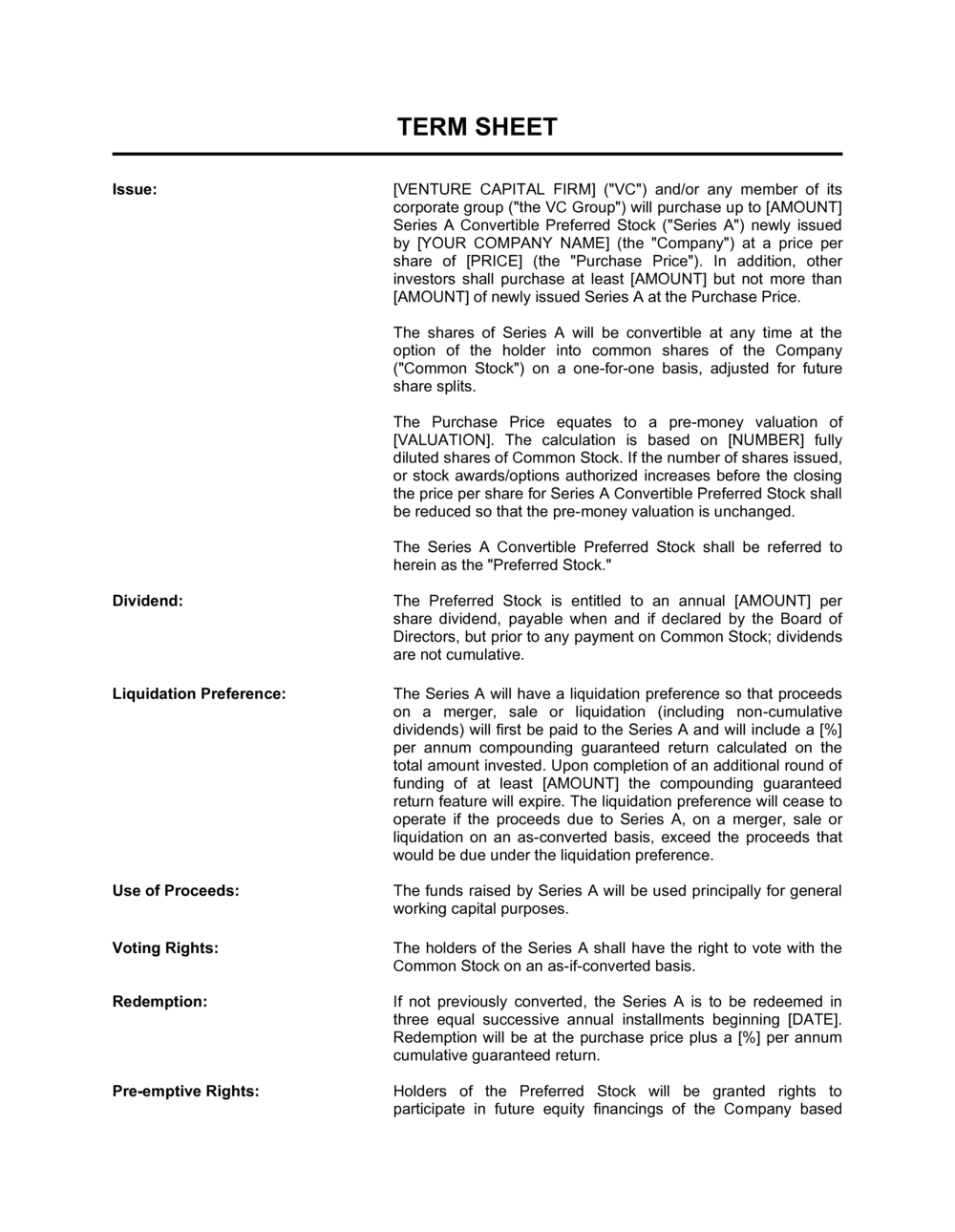

View the key components of a Term Sheet

Navigating the complexities of business deals requires clarity and precision, especially when it comes to financial agreements.

For business owners, a Term Sheet template is an invaluable tool that outlines the key terms of a deal, serving as a preliminary agreement between parties. It streamlines negotiations, sets clear expectations, and forms the basis for legally binding contracts, making it an essential component in the arsenal of business documentation.

What is a Term Sheet Template?

A Term Sheet template is a document that outlines the primary terms and conditions of a proposed agreement between two parties, typically used in business transactions like mergers, acquisitions, or investments.

This non-binding agreement serves as a blueprint for further negotiations, providing a clear structure for the final, legally binding agreement. It simplifies the negotiation process by identifying the key aspects of the deal, allowing both parties to agree on major terms before drafting detailed legal documents.

Key Elements of a Term Sheet Template

A comprehensive Term Sheet Template should include the following elements:- Parties Involved - Identification of the entities entering the agreement.

- Scope of the Agreement - Description of the business transaction or relationship being proposed.

- Financial Terms - Details on valuation, investment amounts, payment schedules, and equity stakes.

- Confidentiality Clauses - Provisions to protect sensitive business information.

- Governing Law - Jurisdiction and legal framework governing the Term Sheet and subsequent agreement.

- Conditions Precedent - Pre-conditions that must be met before the final agreement is executed.

- Exclusivity and Non-Compete Clauses - Terms to prevent parties from engaging in similar negotiations with others for a specified period.

- Termination Provisions - Conditions under which the Term Sheet becomes void.

- Dispute Resolution - Mechanisms for handling disagreements or misunderstandings.

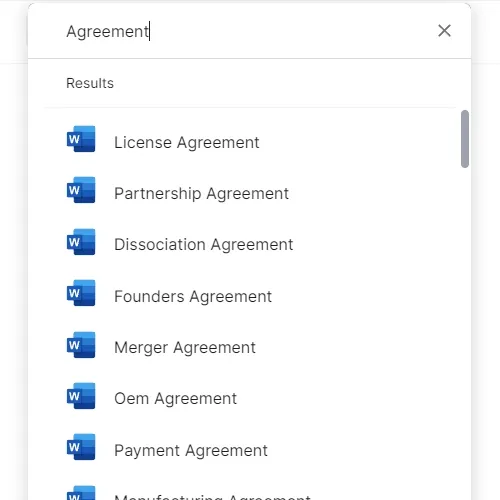

Other Documents Related to a Term Sheet

When preparing a Term Sheet, it’s beneficial to consider related documents such as:

- Non-Disclosure Agreements (NDAs) - To ensure confidentiality during negotiations.

- Letter of Intent (LOI) - Often used alongside or in place of a Term Sheet, outlining the intent to enter into a contract.

- Due Diligence Checklists - For evaluating the other party’s business, financials, and legal standings.

- Final Contract Templates - Such as purchase agreements, partnership agreements, or investment agreements, which will be drafted based on the agreed terms.

Why Use Business in a Box for Your Term Sheet?

For over two decades, Business in a Box has been the go-to resource for business owners seeking reliable and professionally crafted legal and business templates. Over the last 20 years, we’ve served millions of entrepreneurs, business owners, CEOs, and managers, in over 190 countries and territories worldwide.

Our extensive library features over 3,000 business and legal documents, and has been developed through a collaboration with industry experts and lawyers.

Business in a Box is a practical solution for creating a Term Sheet with several advantages

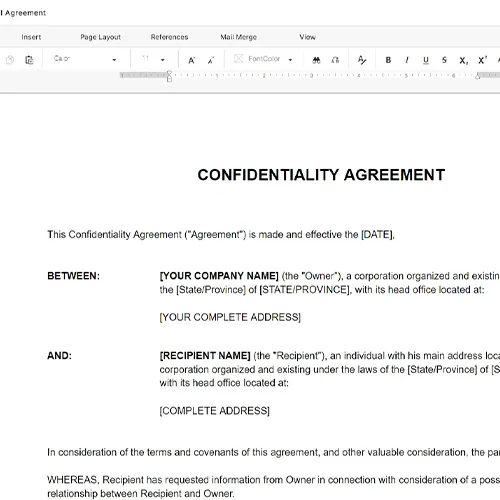

- Professionally Designed Templates - Ensuring that your Term Sheets cover all necessary aspects and are presented in a professional format.

- Customizable Options - Allowing you to tailor the term sheet to the specific needs of your deal and industry standards.

- Efficiency and Accuracy - Streamlining the creation process while reducing the risk of missing critical details.

- Compliance and Relevance - Keeping your documentation in line with current business practices and legal requirements.

Utilizing Business in a Box for your Term Sheet template equips you with a clear, structured, and professional approach to outlining the terms of business deals. It not only saves time and resources but also lays a solid foundation for successful and clear-cut negotiations.

Updated in November 2023

Reviewed on

Crafting an Effective Term Sheet: Essential for Business Agreements

View the key components of a Term Sheet

Navigating the complexities of business deals requires clarity and precision, especially when it comes to financial agreements.

For business owners, a Term Sheet template is an invaluable tool that outlines the key terms of a deal, serving as a preliminary agreement between parties. It streamlines negotiations, sets clear expectations, and forms the basis for legally binding contracts, making it an essential component in the arsenal of business documentation.

What is a Term Sheet Template?

A Term Sheet template is a document that outlines the primary terms and conditions of a proposed agreement between two parties, typically used in business transactions like mergers, acquisitions, or investments.

This non-binding agreement serves as a blueprint for further negotiations, providing a clear structure for the final, legally binding agreement. It simplifies the negotiation process by identifying the key aspects of the deal, allowing both parties to agree on major terms before drafting detailed legal documents.

Key Elements of a Term Sheet Template

A comprehensive Term Sheet Template should include the following elements:- Parties Involved - Identification of the entities entering the agreement.

- Scope of the Agreement - Description of the business transaction or relationship being proposed.

- Financial Terms - Details on valuation, investment amounts, payment schedules, and equity stakes.

- Confidentiality Clauses - Provisions to protect sensitive business information.

- Governing Law - Jurisdiction and legal framework governing the Term Sheet and subsequent agreement.

- Conditions Precedent - Pre-conditions that must be met before the final agreement is executed.

- Exclusivity and Non-Compete Clauses - Terms to prevent parties from engaging in similar negotiations with others for a specified period.

- Termination Provisions - Conditions under which the Term Sheet becomes void.

- Dispute Resolution - Mechanisms for handling disagreements or misunderstandings.

Other Documents Related to a Term Sheet

When preparing a Term Sheet, it’s beneficial to consider related documents such as:

- Non-Disclosure Agreements (NDAs) - To ensure confidentiality during negotiations.

- Letter of Intent (LOI) - Often used alongside or in place of a Term Sheet, outlining the intent to enter into a contract.

- Due Diligence Checklists - For evaluating the other party’s business, financials, and legal standings.

- Final Contract Templates - Such as purchase agreements, partnership agreements, or investment agreements, which will be drafted based on the agreed terms.

Why Use Business in a Box for Your Term Sheet?

For over two decades, Business in a Box has been the go-to resource for business owners seeking reliable and professionally crafted legal and business templates. Over the last 20 years, we’ve served millions of entrepreneurs, business owners, CEOs, and managers, in over 190 countries and territories worldwide.

Our extensive library features over 3,000 business and legal documents, and has been developed through a collaboration with industry experts and lawyers.

Business in a Box is a practical solution for creating a Term Sheet with several advantages

- Professionally Designed Templates - Ensuring that your Term Sheets cover all necessary aspects and are presented in a professional format.

- Customizable Options - Allowing you to tailor the term sheet to the specific needs of your deal and industry standards.

- Efficiency and Accuracy - Streamlining the creation process while reducing the risk of missing critical details.

- Compliance and Relevance - Keeping your documentation in line with current business practices and legal requirements.

Utilizing Business in a Box for your Term Sheet template equips you with a clear, structured, and professional approach to outlining the terms of business deals. It not only saves time and resources but also lays a solid foundation for successful and clear-cut negotiations.

Updated in November 2023

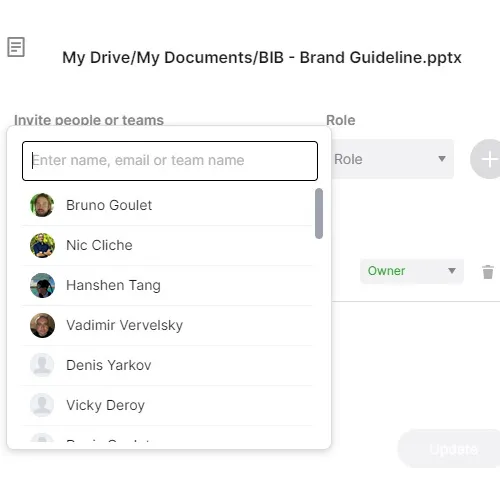

Easily Create Any Business Document You Need in Minutes.

Download or open template

Access over 3,000+ business and legal templates for any business task, project or initiative.

Edit and fill in the blanks

Customize your ready-made business document template and save it in the cloud.

Save, Share, Export, or Sign

Share your files and folders with your team. Create a space of seamless collaboration.