Business Transfer Agreement Template

Navigating Transitions with a Business Transfer Agreement

In the dynamic world of business, the transfer of ownership is a significant milestone that requires careful planning and precision. A Business Transfer Agreement is the cornerstone of a smooth transition, safeguarding the interests of both buyer and seller and ensuring the continuity of operations.

About the Business Transfer Agreement Template

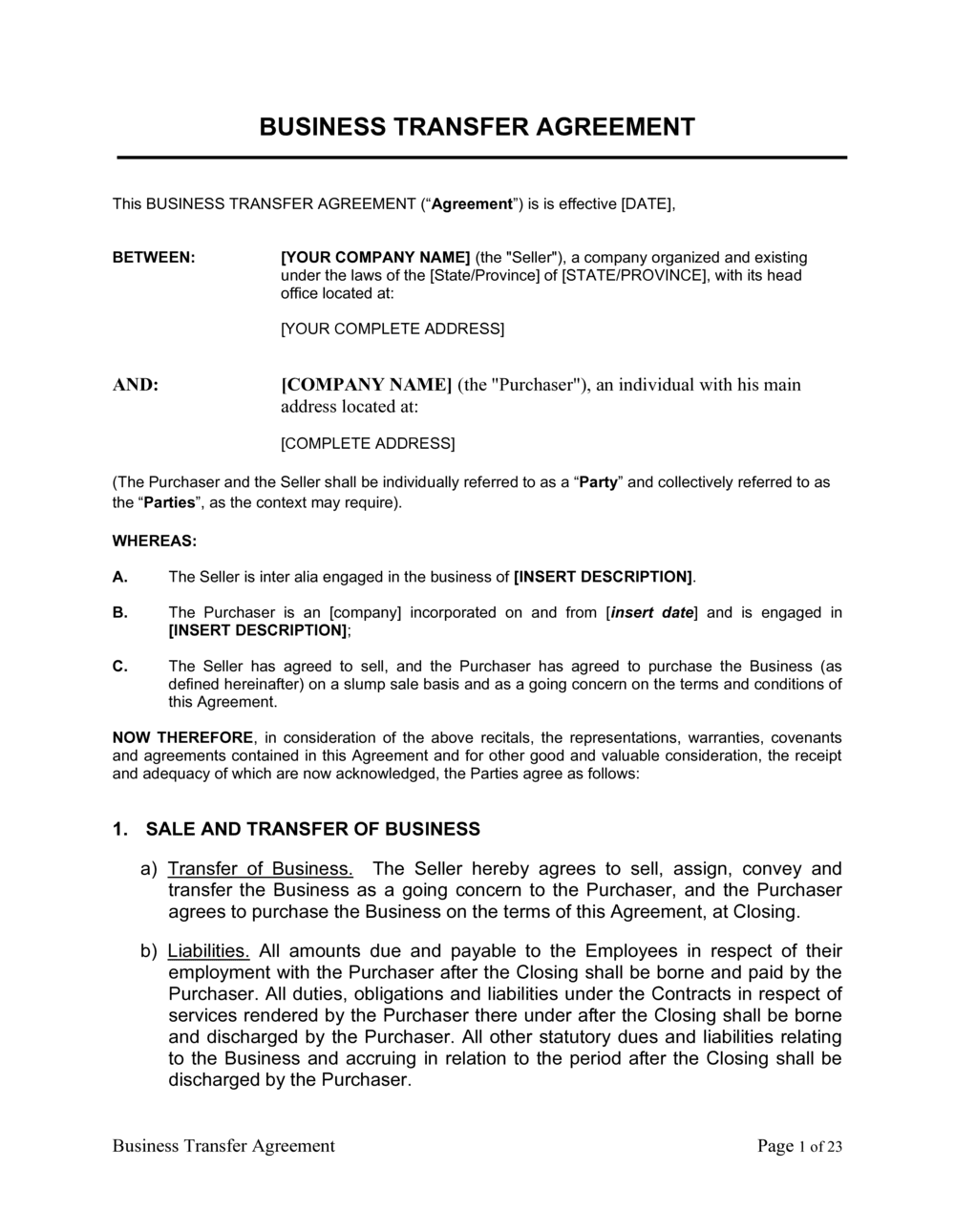

A Business Transfer Agreement Template is a legally binding document that outlines the terms and conditions under which a business is sold and transferred from one owner to another. This template is invaluable for business owners who seek a structured and secure process for transferring ownership, assets, and liabilities.

Key Elements of a Business Transfer Agreement Template

A comprehensive Business Transfer Agreement Template should include:- Parties Involved - Clear identification of the seller and buyer.

- Assets to be Transferred - Detailed list of all assets, including physical, intellectual, and digital properties.

- Liabilities and Obligations - Outline of any debts or responsibilities being transferred.

- Purchase Price - Terms of payment and the sale price.

- Conditions Precedent - Conditions that must be met before the transfer is finalized.

- Warranties and Representations - Guarantees made by both parties regarding the state of the business.

- Confidentiality Clause - Protection of sensitive business information.

- Dispute Resolution - Agreed-upon method for resolving any disputes that arise.

Related Documents for a Business Transfer Agreement

Enhance your Business Transfer Agreement with these related documents:

- Due Diligence Report: - Comprehensive assessment of a business's financial, legal, and operational status.

- Non-Compete Agreement - Legally binds the seller to not start a similar business within a specified area and timeframe.

- Agreement of Transfer - Guarantees employment continuity for existing staff during the business transfer.

- Lease Agreements - Manages the transfer or initiation of property leases critical to the business’s operations.

Why Use Business in a Box to Create Your Business Transfer Agreement?

Business in a Box offers a streamlined solution for crafting your Business Transfer Agreement with several advantages:

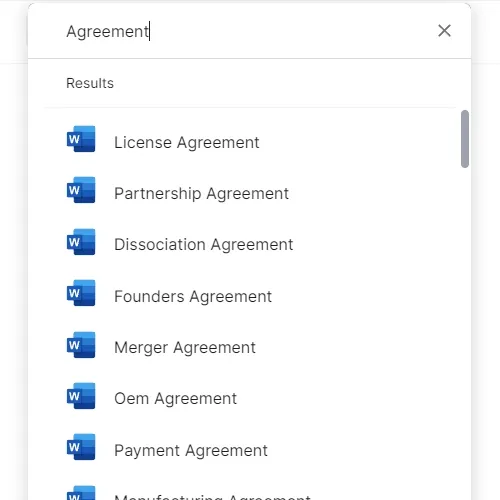

- Expertly Designed Templates: - Access to over 3,000 legal and business documents, including a detailed Business Transfer Agreement Template.

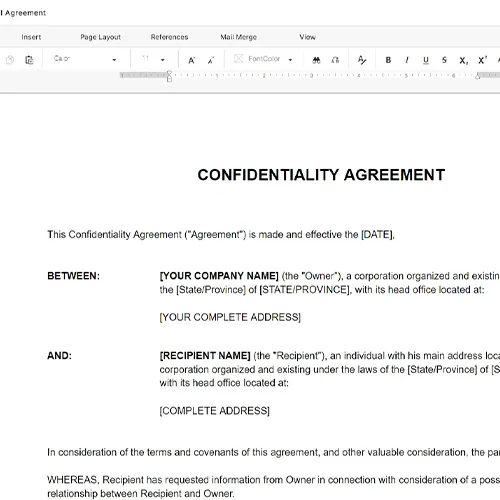

- Customization at Your Fingertips - Tailor the agreement to suit the specific terms and conditions of your business transfer.

- Save Valuable Time - Avoid the complexity and time investment of drafting from scratch, focusing instead on negotiating the best terms.

- Comprehensive Legal and Business Resource - Alongside the Business Transfer Agreement, find all necessary related documents and templates to ensure a seamless transition.

Using Business in a Box for your Business Transfer Agreement equips you with a professional, thorough approach to transferring ownership. This ensures that your business transition is not only legally sound but also aligned with your strategic objectives, paving the way for future success.

Updated in November 2024

Reviewed on

Navigating Transitions with a Business Transfer Agreement

In the dynamic world of business, the transfer of ownership is a significant milestone that requires careful planning and precision. A Business Transfer Agreement is the cornerstone of a smooth transition, safeguarding the interests of both buyer and seller and ensuring the continuity of operations.

About the Business Transfer Agreement Template

A Business Transfer Agreement Template is a legally binding document that outlines the terms and conditions under which a business is sold and transferred from one owner to another. This template is invaluable for business owners who seek a structured and secure process for transferring ownership, assets, and liabilities.

Key Elements of a Business Transfer Agreement Template

A comprehensive Business Transfer Agreement Template should include:- Parties Involved - Clear identification of the seller and buyer.

- Assets to be Transferred - Detailed list of all assets, including physical, intellectual, and digital properties.

- Liabilities and Obligations - Outline of any debts or responsibilities being transferred.

- Purchase Price - Terms of payment and the sale price.

- Conditions Precedent - Conditions that must be met before the transfer is finalized.

- Warranties and Representations - Guarantees made by both parties regarding the state of the business.

- Confidentiality Clause - Protection of sensitive business information.

- Dispute Resolution - Agreed-upon method for resolving any disputes that arise.

Related Documents for a Business Transfer Agreement

Enhance your Business Transfer Agreement with these related documents:

- Due Diligence Report: - Comprehensive assessment of a business's financial, legal, and operational status.

- Non-Compete Agreement - Legally binds the seller to not start a similar business within a specified area and timeframe.

- Agreement of Transfer - Guarantees employment continuity for existing staff during the business transfer.

- Lease Agreements - Manages the transfer or initiation of property leases critical to the business’s operations.

Why Use Business in a Box to Create Your Business Transfer Agreement?

Business in a Box offers a streamlined solution for crafting your Business Transfer Agreement with several advantages:

- Expertly Designed Templates: - Access to over 3,000 legal and business documents, including a detailed Business Transfer Agreement Template.

- Customization at Your Fingertips - Tailor the agreement to suit the specific terms and conditions of your business transfer.

- Save Valuable Time - Avoid the complexity and time investment of drafting from scratch, focusing instead on negotiating the best terms.

- Comprehensive Legal and Business Resource - Alongside the Business Transfer Agreement, find all necessary related documents and templates to ensure a seamless transition.

Using Business in a Box for your Business Transfer Agreement equips you with a professional, thorough approach to transferring ownership. This ensures that your business transition is not only legally sound but also aligned with your strategic objectives, paving the way for future success.

Updated in November 2024

Easily Create Any Business Document You Need in Minutes.

Download or open template

Access over 3,000+ business and legal templates for any business task, project or initiative.

Edit and fill in the blanks

Customize your ready-made business document template and save it in the cloud.

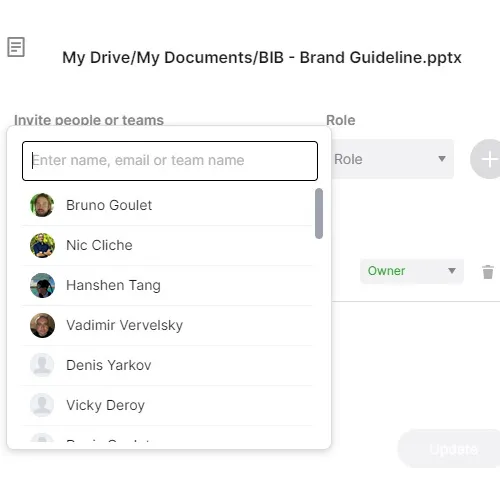

Save, Share, Export, or Sign

Share your files and folders with your team. Create a space of seamless collaboration.