Checklist Debts To Pay First Template

Document description

This checklist debts to pay first template has 3 pages and is a MS Word file type listed under our business plan kit documents.

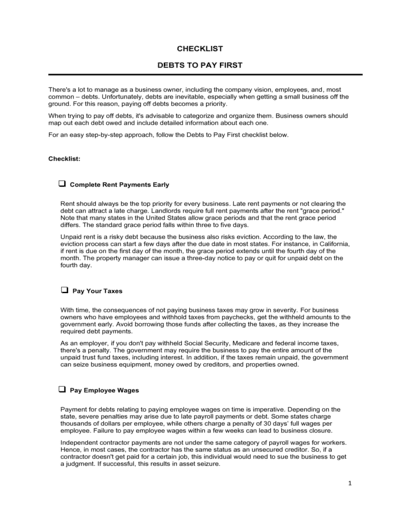

Sample of our checklist debts to pay first template:

Checklist Debts To Pay First

3,000+ Templates & Tools to Help You Start, Run & Grow Your Business

3,000+ Templates & Tools to Help You Start, Run & Grow Your Business

Created by lawyers & experts

Professional-looking formatting

Simply fill-in-the-blanks & print

100% customizable files

Compatible with all office suites

Export to PDF and .doc

All the Templates You Need to Plan, Start, Organize, Manage, Finance & Grow Your Business, in One Place.

Templates and Tools to Manage Every Aspect of Your Business.

8 Business Management Modules, In 1 Place.

Document Types Included

Download Your Checklist Debts To Pay First Template and Crush Your Business Goals With The Business in a Box Toolkit

Business in a Box templates are used by over 250,000 companies in United States, Canada, United Kingdom, Australia, South Africa and 190 countries worldwide.