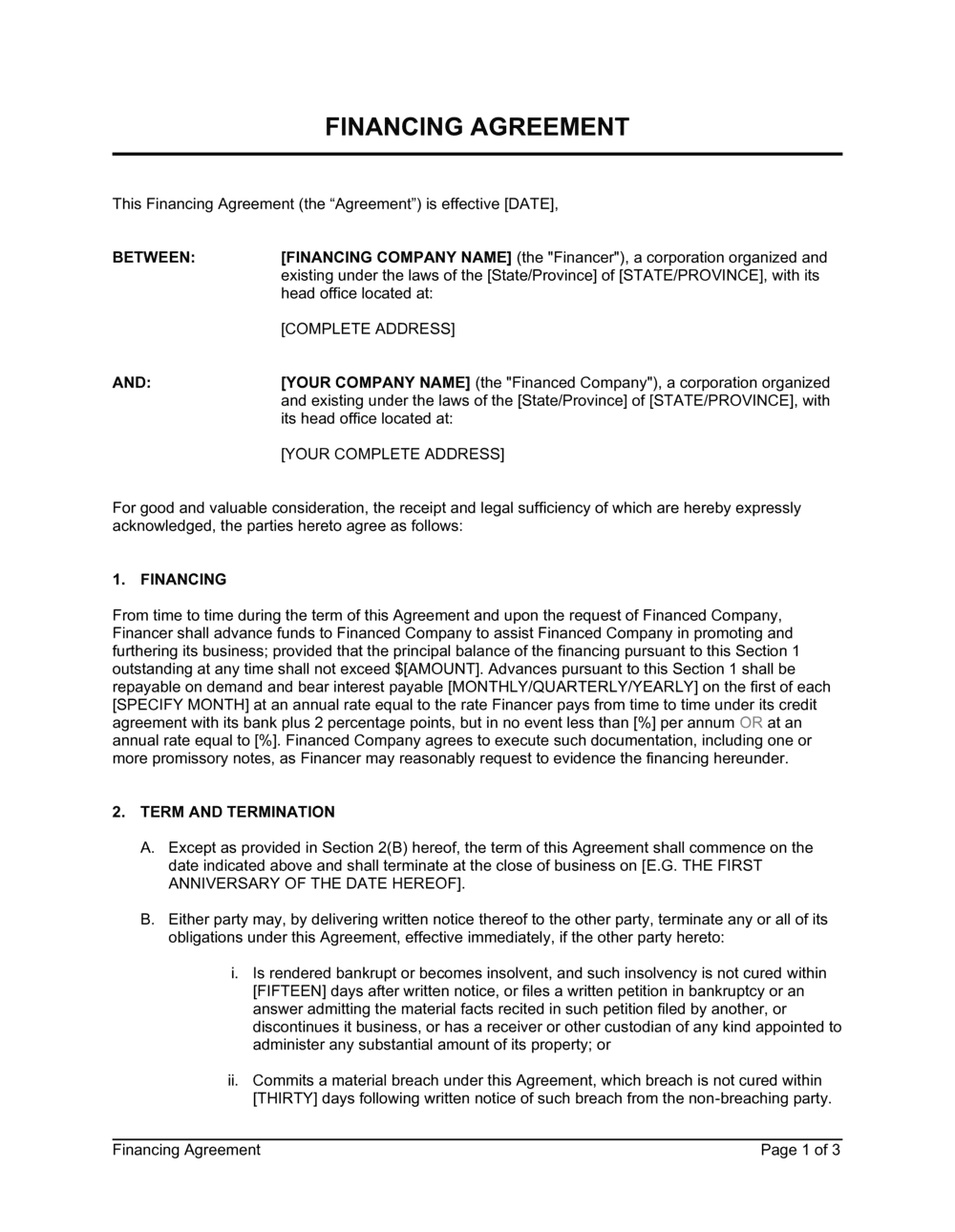

Financing Agreement Template

Securing Financial Clarity with a Financing Agreement

In the business world, a Financing Agreement is vital for defining the terms of a financial transaction between a lender and a borrower. This agreement ensures transparency and clarity, outlining the conditions under which funds are provided and repaid, and the obligations of both parties.

The Financing Agreement acts as a regulatory framework that details the terms of the loan or credit arrangement, safeguarding the interests of both lender and borrower. It specifies the loan amount, repayment schedule, interest rates, and covenants, minimizing the risk of misunderstandings and disputes.

What is a Financing Agreement?

A Financing Agreement is a legally binding document that sets the terms for providing funds to a borrower. It defines the responsibilities of the lender and borrower, including the repayment schedule, interest rate, and any collateral or security, ensuring a transparent and secure financial arrangement.

Key Elements of a Financing Agreement

A comprehensive Financing Agreement should effectively address:

- Loan Amount and Purpose - Specifies the total amount of funds provided and the intended use, ensuring clarity on the transaction's scope.

- Interest Rate and Fees - Details the applicable interest rate, any associated fees, and how interest is calculated, providing transparency in costs.

- Repayment Terms - Outlines the schedule for repaying the loan, including the frequency and amount of payments, to establish a clear repayment plan.

- Collateral and Security - Specifies any assets used as collateral to secure the loan, protecting the lender's interests in case of default.

- Covenants and Conditions - Lists any covenants that the borrower must adhere to during the loan term, ensuring compliance with the agreement.

- Default and Remedies - Defines the conditions under which the loan is considered in default and the actions that can be taken to remedy or address defaults.

Supporting Documents for Implementing a Financing Agreement

To enhance the effectiveness of a Financing Agreement, related documents can be incorporated:

- Promissory Note - Acts as a written promise by the borrower to repay the loan under the agreed terms, providing a legal record of the debt.

- Security Agreement - Details the collateral securing the loan, outlining the lender's rights to the assets in case of default.

- Financial Statements - Provides the lender with the borrower's financial information, helping assess the borrower's creditworthiness.

Why Employ a Detailed Template for a Financing Agreement?

Utilizing a detailed template for drafting your Financing Agreement offers significant benefits:

- Legal Protection - Clearly defines the terms and conditions, reducing the risk of disputes and legal issues.

- Financial Clarity - Ensures both parties understand the financial obligations, minimizing misunderstandings and disputes.

- Risk Mitigation - Specifies collateral and remedies, protecting against potential defaults and securing the lender's interests.

- Operational Efficiency - Streamlines the financing process, enabling a smooth transaction experience.

A well-structured Financing Agreement is crucial for ensuring financial clarity and protecting the interests of both lender and borrower. This essential document not only establishes the terms of the financial transaction but also helps in managing and mitigating risks effectively.

Updated in May 2024

Reviewed on

Securing Financial Clarity with a Financing Agreement

In the business world, a Financing Agreement is vital for defining the terms of a financial transaction between a lender and a borrower. This agreement ensures transparency and clarity, outlining the conditions under which funds are provided and repaid, and the obligations of both parties.

The Financing Agreement acts as a regulatory framework that details the terms of the loan or credit arrangement, safeguarding the interests of both lender and borrower. It specifies the loan amount, repayment schedule, interest rates, and covenants, minimizing the risk of misunderstandings and disputes.

What is a Financing Agreement?

A Financing Agreement is a legally binding document that sets the terms for providing funds to a borrower. It defines the responsibilities of the lender and borrower, including the repayment schedule, interest rate, and any collateral or security, ensuring a transparent and secure financial arrangement.

Key Elements of a Financing Agreement

A comprehensive Financing Agreement should effectively address:

- Loan Amount and Purpose - Specifies the total amount of funds provided and the intended use, ensuring clarity on the transaction's scope.

- Interest Rate and Fees - Details the applicable interest rate, any associated fees, and how interest is calculated, providing transparency in costs.

- Repayment Terms - Outlines the schedule for repaying the loan, including the frequency and amount of payments, to establish a clear repayment plan.

- Collateral and Security - Specifies any assets used as collateral to secure the loan, protecting the lender's interests in case of default.

- Covenants and Conditions - Lists any covenants that the borrower must adhere to during the loan term, ensuring compliance with the agreement.

- Default and Remedies - Defines the conditions under which the loan is considered in default and the actions that can be taken to remedy or address defaults.

Supporting Documents for Implementing a Financing Agreement

To enhance the effectiveness of a Financing Agreement, related documents can be incorporated:

- Promissory Note - Acts as a written promise by the borrower to repay the loan under the agreed terms, providing a legal record of the debt.

- Security Agreement - Details the collateral securing the loan, outlining the lender's rights to the assets in case of default.

- Financial Statements - Provides the lender with the borrower's financial information, helping assess the borrower's creditworthiness.

Why Employ a Detailed Template for a Financing Agreement?

Utilizing a detailed template for drafting your Financing Agreement offers significant benefits:

- Legal Protection - Clearly defines the terms and conditions, reducing the risk of disputes and legal issues.

- Financial Clarity - Ensures both parties understand the financial obligations, minimizing misunderstandings and disputes.

- Risk Mitigation - Specifies collateral and remedies, protecting against potential defaults and securing the lender's interests.

- Operational Efficiency - Streamlines the financing process, enabling a smooth transaction experience.

A well-structured Financing Agreement is crucial for ensuring financial clarity and protecting the interests of both lender and borrower. This essential document not only establishes the terms of the financial transaction but also helps in managing and mitigating risks effectively.

Updated in May 2024

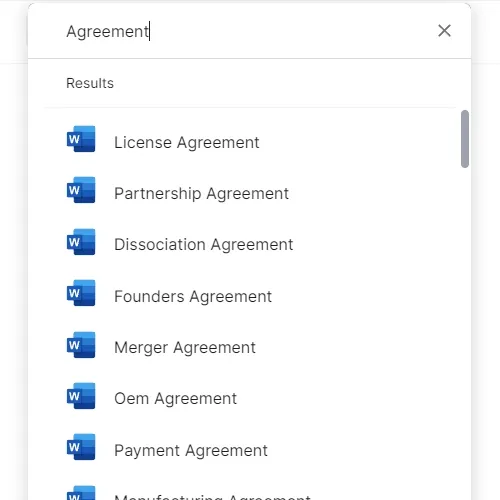

Easily Create Any Business Document You Need in Minutes.

Download or open template

Access over 3,000+ business and legal templates for any business task, project or initiative.

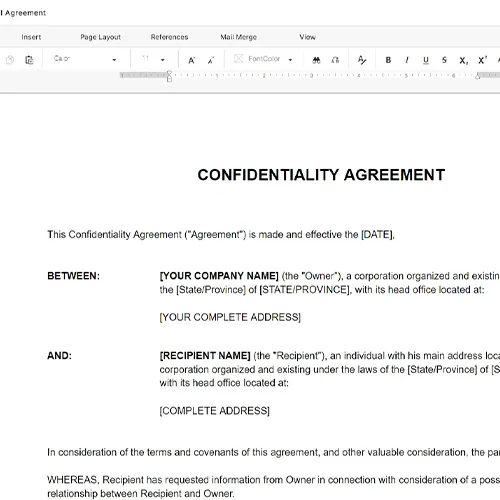

Edit and fill in the blanks

Customize your ready-made business document template and save it in the cloud.

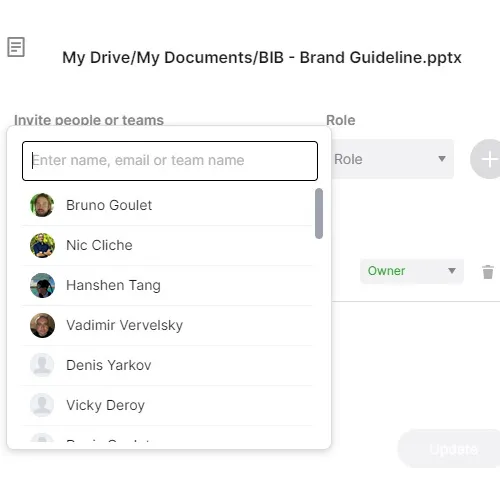

Save, Share, Export, or Sign

Share your files and folders with your team. Create a space of seamless collaboration.