Checklist Making An Insurance Claim

Document content

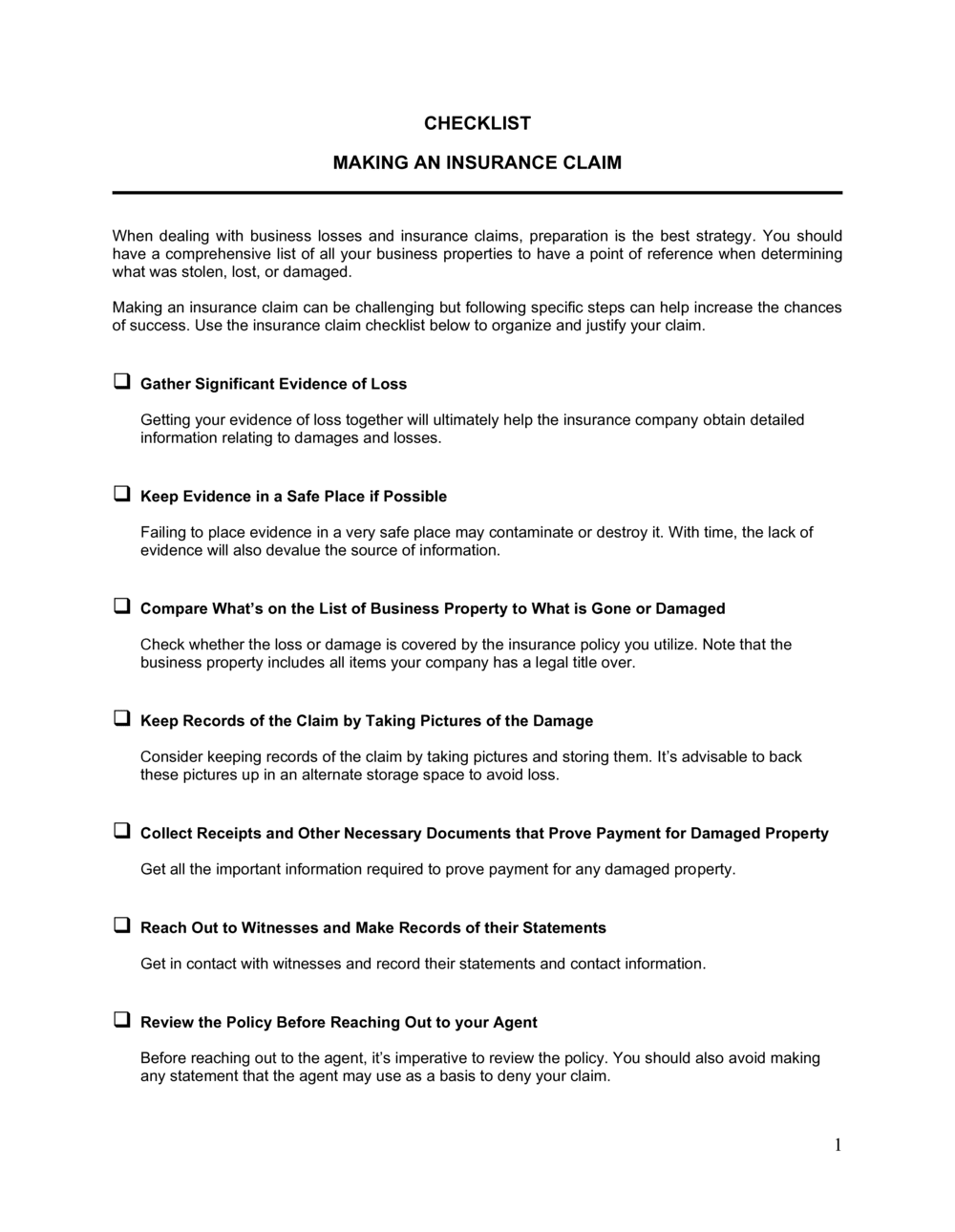

This checklist making an insurance claim template has 3 pages and is a MS Word file type listed under our finance & accounting documents.

Sample of our checklist making an insurance claim template:

CHECKLIST MAKING AN INSURANCE CLAIM When dealing with business losses and insurance claims, preparation is the best strategy. You should have a comprehensive list of all your business properties to have a point of reference when determining what was stolen, lost, or damaged. Making an insurance claim can be challenging but following specific steps can help increase the chances of success. Use the insurance claim checklist below to organize and justify your claim. Gather Significant Evidence of Loss Getting your evidence of loss together will ultimately help the insurance company obtain detailed information relating to damages and losses. Keep Evidence in a Safe Place if Possible Failing to place evidence in a very safe place may contaminate or destroy it. With time, the lack of evidence will also devalue the source of information. Compare What's on the List of Business Property to What is Gone or Damaged Check whether the loss or damage is covered by the insurance policy you utilize. Note that the business property includes all items your company has a legal title over. Keep Records of the Claim by Taking Pictures of the Damage Consider keeping records of the claim by taking pictures and storing them. It's advisable to back these pictures up in an alternate storage space to avoid loss. Collect Receipts and Other Necessary Documents that Prove Payment for Damaged Property Get all the important information required to prove payment for any damaged property. Reach Out to Witnesses and Make Records of their Statements

Reviewed on

Document content

This checklist making an insurance claim template has 3 pages and is a MS Word file type listed under our finance & accounting documents.

Sample of our checklist making an insurance claim template:

CHECKLIST MAKING AN INSURANCE CLAIM When dealing with business losses and insurance claims, preparation is the best strategy. You should have a comprehensive list of all your business properties to have a point of reference when determining what was stolen, lost, or damaged. Making an insurance claim can be challenging but following specific steps can help increase the chances of success. Use the insurance claim checklist below to organize and justify your claim. Gather Significant Evidence of Loss Getting your evidence of loss together will ultimately help the insurance company obtain detailed information relating to damages and losses. Keep Evidence in a Safe Place if Possible Failing to place evidence in a very safe place may contaminate or destroy it. With time, the lack of evidence will also devalue the source of information. Compare What's on the List of Business Property to What is Gone or Damaged Check whether the loss or damage is covered by the insurance policy you utilize. Note that the business property includes all items your company has a legal title over. Keep Records of the Claim by Taking Pictures of the Damage Consider keeping records of the claim by taking pictures and storing them. It's advisable to back these pictures up in an alternate storage space to avoid loss. Collect Receipts and Other Necessary Documents that Prove Payment for Damaged Property Get all the important information required to prove payment for any damaged property. Reach Out to Witnesses and Make Records of their Statements

Easily Create Any Business Document You Need in Minutes.

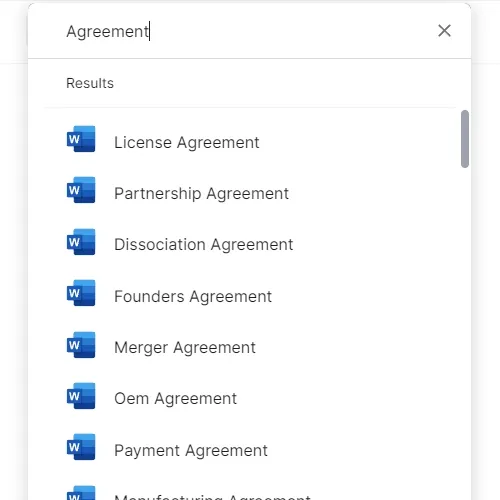

Download or open template

Access over 3,000+ business and legal templates for any business task, project or initiative.

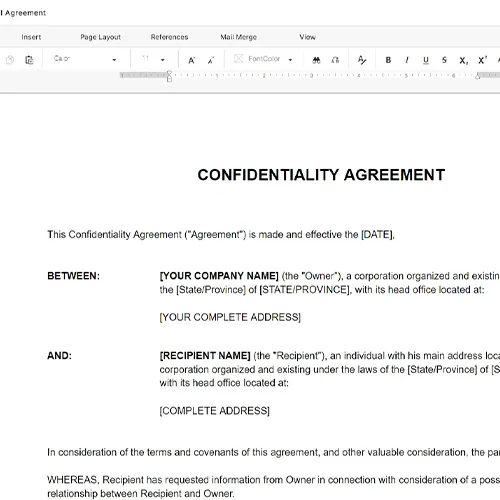

Edit and fill in the blanks

Customize your ready-made business document template and save it in the cloud.

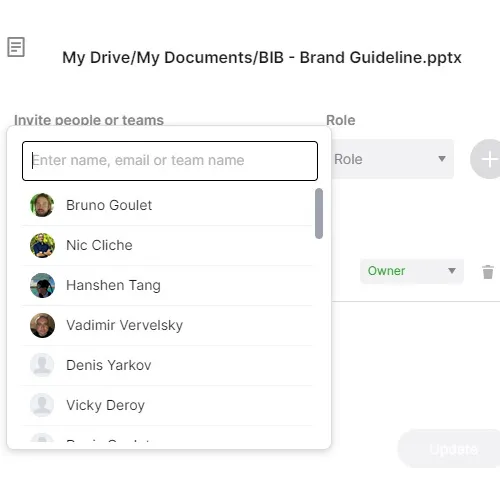

Save, Share, Export, or Sign

Share your files and folders with your team. Create a space of seamless collaboration.