Checklist Business Insurance

Document content

This checklist business insurance template has 3 pages and is a MS Word file type listed under our business plan kit documents.

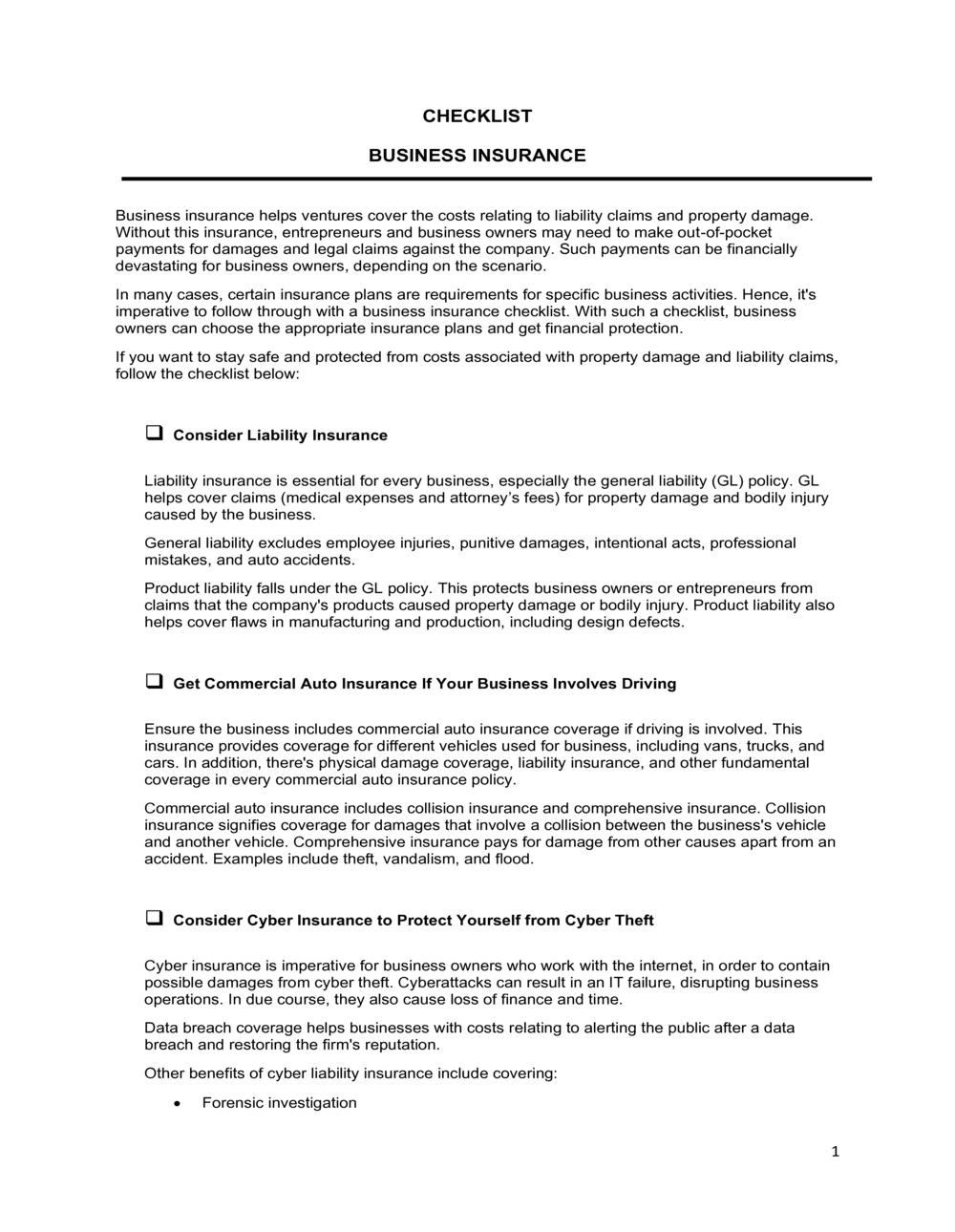

Sample of our checklist business insurance template:

CHECKLIST BUSINESS INSURANCE Business insurance helps ventures cover the costs relating to liability claims and property damage. Without this insurance, entrepreneurs and business owners may need to make out-of-pocket payments for damages and legal claims against the company. Such payments can be financially devastating for business owners, depending on the scenario. In many cases, certain insurance plans are requirements for specific business activities. Hence, it's imperative to follow through with a business insurance checklist. With such a checklist, business owners can choose the appropriate insurance plans and get financial protection. If you want to stay safe and protected from costs associated with property damage and liability claims, follow the checklist below: Consider Liability Insurance Liability insurance is essential for every business, especially the general liability (GL) policy. GL helps cover claims (medical expenses and attorney's fees) for property damage and bodily injury caused by the business. General liability excludes employee injuries, punitive damages, intentional acts, professional mistakes, and auto accidents. Product liability falls under the GL policy. This protects business owners or entrepreneurs from claims that the company's products caused property damage or bodily injury. Product liability also helps cover flaws in manufacturing and production, including design defects. Get Commercial Auto Insurance If Your Business Involves Driving Ensure the business includes commercial auto insurance coverage if driving is involved. This insurance provides coverage for different vehicles used for business, including vans, trucks, and cars. In addition, there's physical damage coverage, liability insurance, and other fundamental coverage in every commercial auto insurance policy. Commercial auto insurance includes collision insurance and comprehensive insurance. Collision insurance signifies coverage for damages that involve a collision between the business's vehicle and another vehicle. Comprehensive insurance pays for damage from other causes apart from an accident. Examples include theft, vandalism, and flood. Consider Cyber Insurance to Protect Yourself from Cyber Theft Cyber insurance is imperative for business owners who work with the internet, in order to contain possible damages from cyber theft. Cyberattacks can result in an IT failure, disrupting business operations. In due course, they also cause loss of finance and time. Data breach coverage helps businesses with costs relating to alerting the public after a data breach and restoring the firm's reputation. Other benefits of cyber liability insurance include covering: Forensic investigation Regulatory defense expenses/fines Business interruption Litigation expenses Crisis management expenses Use Commercial Umbrella Insurance for Possible Additional Costs Small to medium businesses also need commercial umbrella insurance for scenarios where the liability claim exceeds the business's policy limits. The coverage helps with additional legal costs, damages, medical bills, and out-of-pocket expenses. Commercial umbrella insurance doesn't come as a stand-alone coverage policy; instead, it's in conjunction with other liability coverages. Similar to business liability insurance, commercial umbrella insurance deals with attorney's fees, medical expenses, and damages

Reviewed on

Document content

This checklist business insurance template has 3 pages and is a MS Word file type listed under our business plan kit documents.

Sample of our checklist business insurance template:

CHECKLIST BUSINESS INSURANCE Business insurance helps ventures cover the costs relating to liability claims and property damage. Without this insurance, entrepreneurs and business owners may need to make out-of-pocket payments for damages and legal claims against the company. Such payments can be financially devastating for business owners, depending on the scenario. In many cases, certain insurance plans are requirements for specific business activities. Hence, it's imperative to follow through with a business insurance checklist. With such a checklist, business owners can choose the appropriate insurance plans and get financial protection. If you want to stay safe and protected from costs associated with property damage and liability claims, follow the checklist below: Consider Liability Insurance Liability insurance is essential for every business, especially the general liability (GL) policy. GL helps cover claims (medical expenses and attorney's fees) for property damage and bodily injury caused by the business. General liability excludes employee injuries, punitive damages, intentional acts, professional mistakes, and auto accidents. Product liability falls under the GL policy. This protects business owners or entrepreneurs from claims that the company's products caused property damage or bodily injury. Product liability also helps cover flaws in manufacturing and production, including design defects. Get Commercial Auto Insurance If Your Business Involves Driving Ensure the business includes commercial auto insurance coverage if driving is involved. This insurance provides coverage for different vehicles used for business, including vans, trucks, and cars. In addition, there's physical damage coverage, liability insurance, and other fundamental coverage in every commercial auto insurance policy. Commercial auto insurance includes collision insurance and comprehensive insurance. Collision insurance signifies coverage for damages that involve a collision between the business's vehicle and another vehicle. Comprehensive insurance pays for damage from other causes apart from an accident. Examples include theft, vandalism, and flood. Consider Cyber Insurance to Protect Yourself from Cyber Theft Cyber insurance is imperative for business owners who work with the internet, in order to contain possible damages from cyber theft. Cyberattacks can result in an IT failure, disrupting business operations. In due course, they also cause loss of finance and time. Data breach coverage helps businesses with costs relating to alerting the public after a data breach and restoring the firm's reputation. Other benefits of cyber liability insurance include covering: Forensic investigation Regulatory defense expenses/fines Business interruption Litigation expenses Crisis management expenses Use Commercial Umbrella Insurance for Possible Additional Costs Small to medium businesses also need commercial umbrella insurance for scenarios where the liability claim exceeds the business's policy limits. The coverage helps with additional legal costs, damages, medical bills, and out-of-pocket expenses. Commercial umbrella insurance doesn't come as a stand-alone coverage policy; instead, it's in conjunction with other liability coverages. Similar to business liability insurance, commercial umbrella insurance deals with attorney's fees, medical expenses, and damages

Easily Create Any Business Document You Need in Minutes.

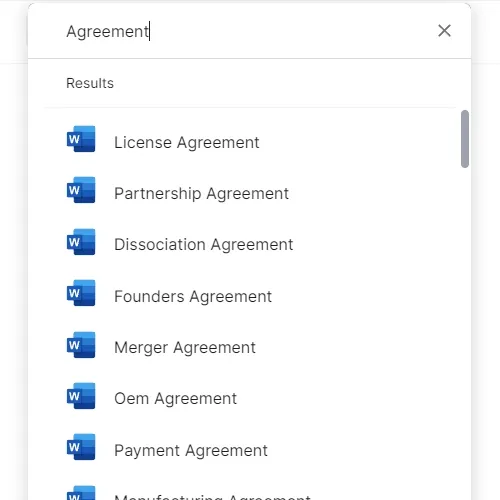

Download or open template

Access over 3,000+ business and legal templates for any business task, project or initiative.

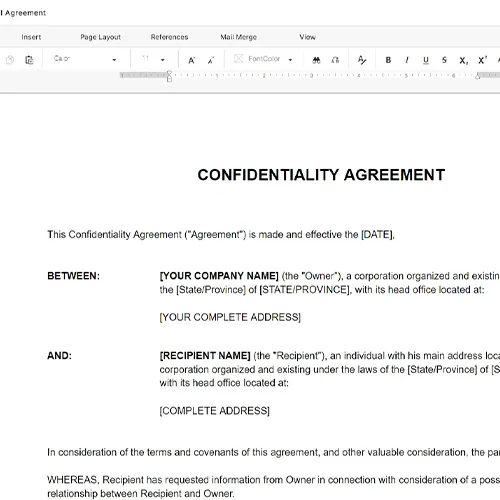

Edit and fill in the blanks

Customize your ready-made business document template and save it in the cloud.

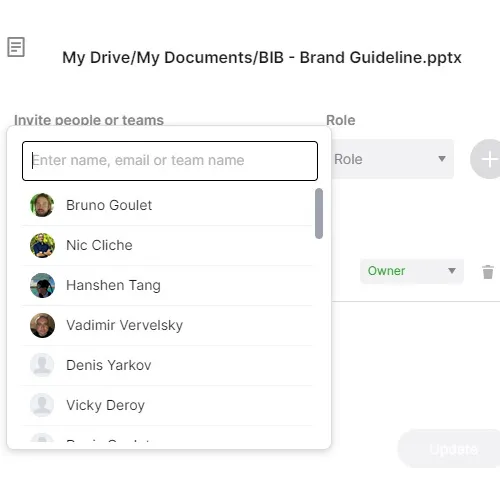

Save, Share, Export, or Sign

Share your files and folders with your team. Create a space of seamless collaboration.