Business Credit Application Template

Understanding a Credit Application Template

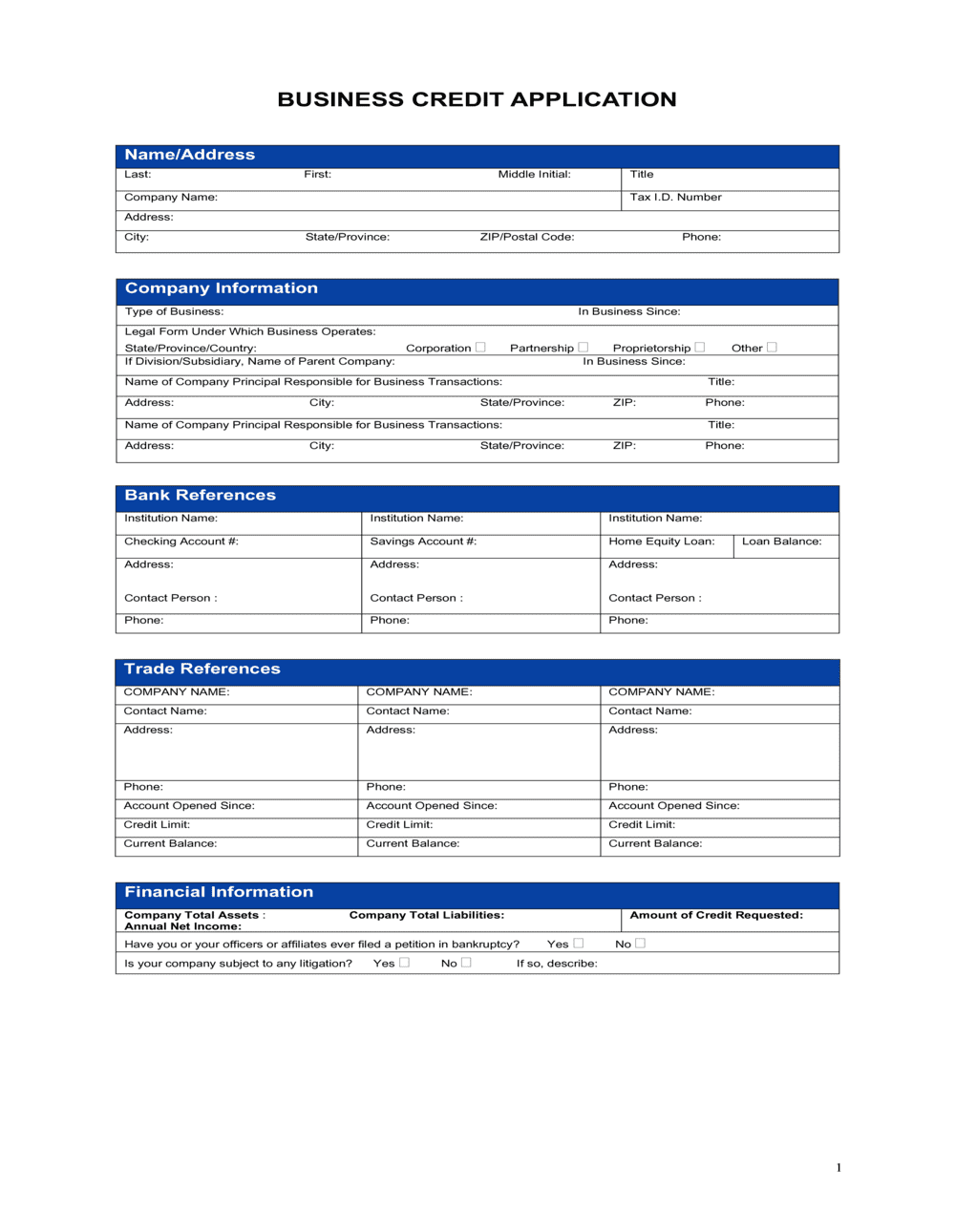

View the key components of a Credit Application

For business owners, extending credit is a strategic decision that can drive sales and build customer loyalty.

However, doing so also comes with risks.

A Credit Application template serves as a vital tool in this process, providing a structured and thorough approach to assess the creditworthiness of potential clients. Implementing a standardized Credit Application process not only safeguards your business’s financial health but also streamlines your credit decision-making.

What is a Credit Application Template?

A Credit Application template is a crucial document used by businesses to gather essential financial and personal information from clients seeking credit.

This template serves as a formal request for credit, allowing businesses to evaluate the creditworthiness and financial stability of their clients. It outlines the necessary information and terms required for a business to make an informed decision about extending credit. This document is key to establishing clear credit terms and conditions and is instrumental in building a foundation for a healthy creditor-client relationship.

Key Elements in a Credit Application Template

An effective Credit Application Template includes:- Client Information - Comprehensive details such as the client's name, address, contact information, and business structure.

- Financial Information - Bank details, financial statements, and credit references to assess the client's financial health.

- Credit Terms - Clearly defined credit terms, including payment deadlines, interest rates, and credit limits.

- Legal Clauses - Conditions that bind the client to the agreement, such as confidentiality and compliance with payment terms.

- Personal or Corporate Guarantee - A clause ensuring repayment, enhancing the security of the credit extended.

- Consent for Credit Checks - Authorization from the client to conduct credit checks and verify provided information.

- Signatures - Space for authorized signatures to validate the agreement.

Other Documents Related to Credit Applications

When drafting a Credit Application, consider including these related documents:

- Credit Policy - Outlines your business’s overall credit granting criteria and procedures.

- Terms and Conditions of Sale - Details the terms under which your products or services are sold.

- Personal Guarantee Forms - For additional security, especially in dealings with smaller businesses or startups.

- Loan Agreement - If the Credit Application leads to a more structured financing arrangement.

Why Use Business in a Box for Your Credit Application?

For over two decades, Business in a Box has been the go-to resource for business owners seeking reliable and professionally crafted legal and business templates. Over the last 20 years, we’ve served millions of entrepreneurs, business owners, CEOs, and managers, in over 190 countries and territories worldwide.

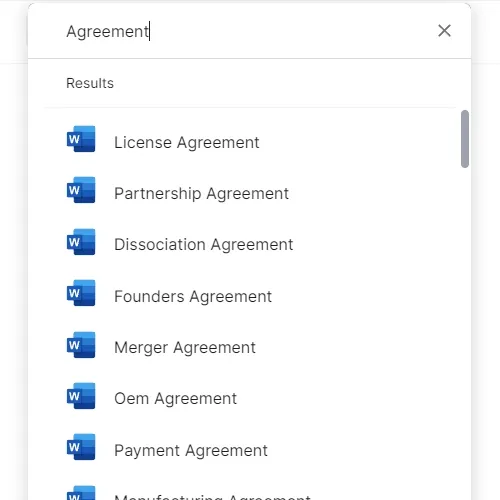

Our extensive library features over 3,000 business and legal documents, and has been developed through a collaboration with industry experts and lawyers.

Business in a Box offers a user-friendly solution for creating your Credit Application with several advantages:

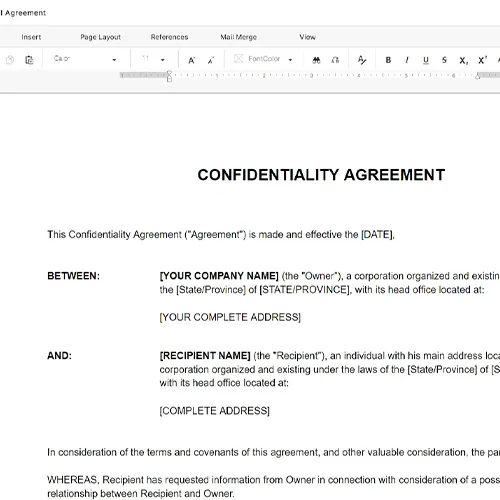

- Professionally Prepared Templates - Ensures that your Credit Applications are thorough, legally sound, and tailored to industry standards.

- Customization - Easily modify templates to fit the unique needs of your business and your clients.

- Time Efficiency - Streamlines the creation process, allowing you to focus on other critical aspects of your business.

- Legal Compliance - Keeps your Credit Application process in line with current financial regulations and laws.

Utilizing Business in a Box for your Credit Application template empowers you to make smarter credit decisions, protects your business from financial risks, and fosters trust and transparency with your clients. Access a range of professionally designed templates in Business in a Box and manage your credit processes more effectively.

Updated in November 2023

Reviewed on

Understanding a Credit Application Template

View the key components of a Credit Application

For business owners, extending credit is a strategic decision that can drive sales and build customer loyalty.

However, doing so also comes with risks.

A Credit Application template serves as a vital tool in this process, providing a structured and thorough approach to assess the creditworthiness of potential clients. Implementing a standardized Credit Application process not only safeguards your business’s financial health but also streamlines your credit decision-making.

What is a Credit Application Template?

A Credit Application template is a crucial document used by businesses to gather essential financial and personal information from clients seeking credit.

This template serves as a formal request for credit, allowing businesses to evaluate the creditworthiness and financial stability of their clients. It outlines the necessary information and terms required for a business to make an informed decision about extending credit. This document is key to establishing clear credit terms and conditions and is instrumental in building a foundation for a healthy creditor-client relationship.

Key Elements in a Credit Application Template

An effective Credit Application Template includes:- Client Information - Comprehensive details such as the client's name, address, contact information, and business structure.

- Financial Information - Bank details, financial statements, and credit references to assess the client's financial health.

- Credit Terms - Clearly defined credit terms, including payment deadlines, interest rates, and credit limits.

- Legal Clauses - Conditions that bind the client to the agreement, such as confidentiality and compliance with payment terms.

- Personal or Corporate Guarantee - A clause ensuring repayment, enhancing the security of the credit extended.

- Consent for Credit Checks - Authorization from the client to conduct credit checks and verify provided information.

- Signatures - Space for authorized signatures to validate the agreement.

Other Documents Related to Credit Applications

When drafting a Credit Application, consider including these related documents:

- Credit Policy - Outlines your business’s overall credit granting criteria and procedures.

- Terms and Conditions of Sale - Details the terms under which your products or services are sold.

- Personal Guarantee Forms - For additional security, especially in dealings with smaller businesses or startups.

- Loan Agreement - If the Credit Application leads to a more structured financing arrangement.

Why Use Business in a Box for Your Credit Application?

For over two decades, Business in a Box has been the go-to resource for business owners seeking reliable and professionally crafted legal and business templates. Over the last 20 years, we’ve served millions of entrepreneurs, business owners, CEOs, and managers, in over 190 countries and territories worldwide.

Our extensive library features over 3,000 business and legal documents, and has been developed through a collaboration with industry experts and lawyers.

Business in a Box offers a user-friendly solution for creating your Credit Application with several advantages:

- Professionally Prepared Templates - Ensures that your Credit Applications are thorough, legally sound, and tailored to industry standards.

- Customization - Easily modify templates to fit the unique needs of your business and your clients.

- Time Efficiency - Streamlines the creation process, allowing you to focus on other critical aspects of your business.

- Legal Compliance - Keeps your Credit Application process in line with current financial regulations and laws.

Utilizing Business in a Box for your Credit Application template empowers you to make smarter credit decisions, protects your business from financial risks, and fosters trust and transparency with your clients. Access a range of professionally designed templates in Business in a Box and manage your credit processes more effectively.

Updated in November 2023

Easily Create Any Business Document You Need in Minutes.

Download or open template

Access over 3,000+ business and legal templates for any business task, project or initiative.

Edit and fill in the blanks

Customize your ready-made business document template and save it in the cloud.

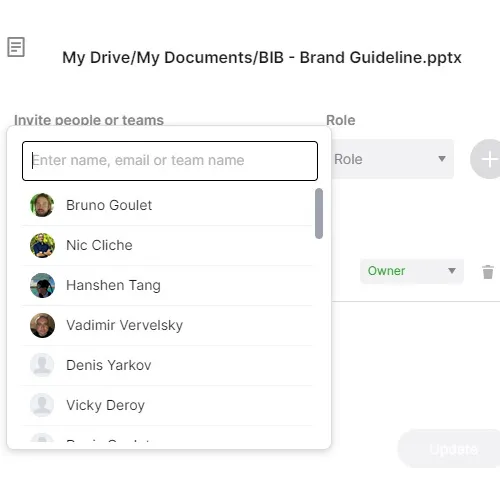

Save, Share, Export, or Sign

Share your files and folders with your team. Create a space of seamless collaboration.