How To Choose The Best Business Legal Structure

Document content

This how to choose the best business legal structure template has 3 pages and is a MS Word file type listed under our business plan kit documents.

Sample of our how to choose the best business legal structure template:

HOW TO CHOOSE THE BEST BUSINESS LEGAL STRUCTURE Your legal structure is more critical to your business than you may expect. In addition to influencing your tax burden, it may also impact your liability. This brief guide will help you understand how different business legal structures work. You can use these details to help determine which would fit your business the best. What Is a Business Legal Structure? The legal structure of your business refers to the government classification that determines various matters with regard to your business. The format can influence the following: The taxes you will owe Liability considerations The formation process How to distinguish between the individual and the business Understanding the Common Business Legal Structures There are four major business legal structures to explore when managing how your business operates. Here is a closer look at each of these options. Sole Proprietorship A sole proprietorship involves one person. It does not create separation between the owner and the business. A sole proprietorship pays taxes through the owner's personal tax return via a Schedule C or 1040 form. The business does not file a separate tax return in this case. The owner of the business is also personally liable for all operations, meaning you could be sued for anything that happens within your business. Forming a sole proprietorship is easy, as it entails filing a certificate with your local entity and acquiring an employer identification number. You may need to acquire certain licenses and permits, but the rules can vary by location. Partnership You can establish a partnership with other people. A partnership involves many people working in the same business but with rules for how much of the entity they own, how they share profits and losses, and management rights. A partnership will file its taxes through Form 1065, the Return of Partnership Income form. The group doesn't pay federal income tax, but it must record income and losses. The owners will receive their profits and losses based on the profit-sharing percentages they agree to, with each partner paying their share of taxes. There is little paperwork involved in forming a partnership. You'll need to draft your articles of the partnership agreement and obtain a business license in most situations. The agreement must cover management duties, bookkeeping and banking, and dissolution rules. Limited Liability Company

Reviewed on

Document content

This how to choose the best business legal structure template has 3 pages and is a MS Word file type listed under our business plan kit documents.

Sample of our how to choose the best business legal structure template:

HOW TO CHOOSE THE BEST BUSINESS LEGAL STRUCTURE Your legal structure is more critical to your business than you may expect. In addition to influencing your tax burden, it may also impact your liability. This brief guide will help you understand how different business legal structures work. You can use these details to help determine which would fit your business the best. What Is a Business Legal Structure? The legal structure of your business refers to the government classification that determines various matters with regard to your business. The format can influence the following: The taxes you will owe Liability considerations The formation process How to distinguish between the individual and the business Understanding the Common Business Legal Structures There are four major business legal structures to explore when managing how your business operates. Here is a closer look at each of these options. Sole Proprietorship A sole proprietorship involves one person. It does not create separation between the owner and the business. A sole proprietorship pays taxes through the owner's personal tax return via a Schedule C or 1040 form. The business does not file a separate tax return in this case. The owner of the business is also personally liable for all operations, meaning you could be sued for anything that happens within your business. Forming a sole proprietorship is easy, as it entails filing a certificate with your local entity and acquiring an employer identification number. You may need to acquire certain licenses and permits, but the rules can vary by location. Partnership You can establish a partnership with other people. A partnership involves many people working in the same business but with rules for how much of the entity they own, how they share profits and losses, and management rights. A partnership will file its taxes through Form 1065, the Return of Partnership Income form. The group doesn't pay federal income tax, but it must record income and losses. The owners will receive their profits and losses based on the profit-sharing percentages they agree to, with each partner paying their share of taxes. There is little paperwork involved in forming a partnership. You'll need to draft your articles of the partnership agreement and obtain a business license in most situations. The agreement must cover management duties, bookkeeping and banking, and dissolution rules. Limited Liability Company

Easily Create Any Business Document You Need in Minutes.

Download or open template

Access over 3,000+ business and legal templates for any business task, project or initiative.

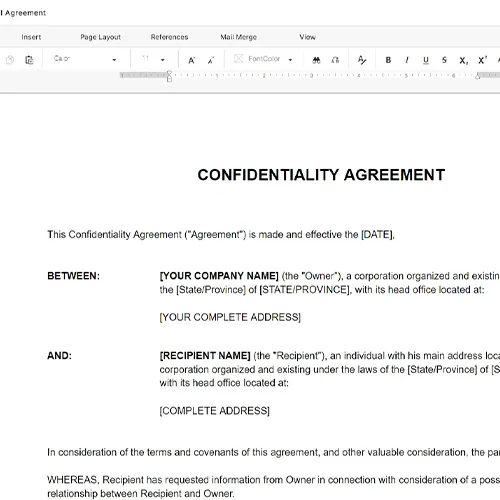

Edit and fill in the blanks

Customize your ready-made business document template and save it in the cloud.

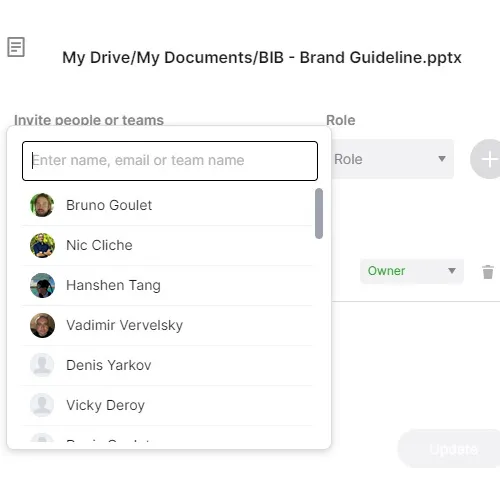

Save, Share, Export, or Sign

Share your files and folders with your team. Create a space of seamless collaboration.