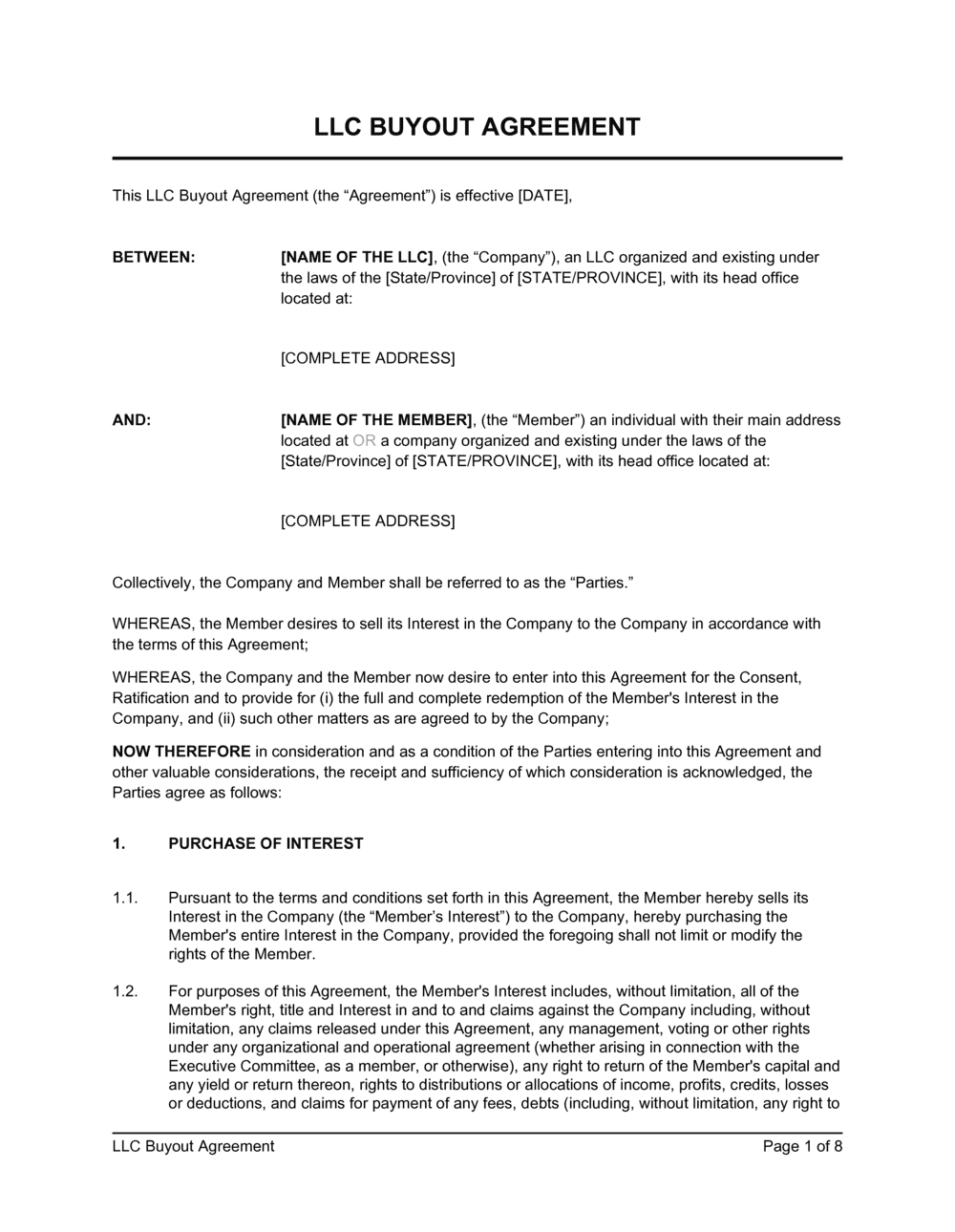

LLC Buyout Agreement Template

Understanding an Exclusive Partnership Agreement

An LLC Buyout Agreement stands as a cornerstone document that safeguards the interests of members within a Limited Liability Company (LLC) by outlining procedures and provisions for the buyout of a departing member's ownership stake. Like most LLC Operating Agreements, this comprehensive agreement serves as a protective shield against uncertainties that may arise during ownership transitions and facilitates the seamless continuation of business operations. In this article, we'll delve into the intricacies of an LLC Buyout Agreement, explore its importance for business sustainability, and shed light on key questions surrounding its components, implications, and advantages.

Exploring the Landscape of an LLC Buyout Agreement

An LLC Buyout Agreement stands as a strategic pact that casts aguiding light on the path to be taken when a member of a LimitedLiability Company (LLC) opts to withdraw from the company. Withinthe contours of this comprehensive agreement lie intricately woventhreads that encompass pivotal details: from the intricatevaluation of the departing member's ownership interest to themechanics of compensation, all enveloped within the protectiveembrace of a meticulously constructed legal framework. Thisagreement, akin to a well-crafted blueprint, deftly erects apre-defined roadmap, steering the course of buyout scenarios whileadeptly minimizing potential conflicts, illuminating clarity, andfurnishing a robust framework for realizing equitable resolutions.

Decoding the Components of an LLC Buyout Agreement

At the core of an LLC Buyout Agreement, crucial components form a cohesive structure that guides a seamless transition of ownership. These interlinked elements work together to create a well-organized agreement, benefiting all stakeholders:

Valuation Methodology: At the core of the agreement lies the method used to determine the departing member's ownership interest. This method could involve book value, fair market value, or agreed-upon formulas, all contributing to transparency and a fair price.

Buyout Triggers: This aspect takes center stage, outlining scenarios that lead to a buyout—retirement, resignation, incapacitation, or voluntary exit. It serves as a guiding star for ownership transitions.

Buyout Process: Within the agreement, the buyout process is a carefully choreographed sequence. It defines the timeline, communication rules, and roles of the departing and remaining members.

Compensation Mechanism: The compensation section reveals how the departing member will be paid. This could be a lump sum, installment plans, or structured payments over time.

Funding Arrangements: Funding is prominent, detailing how financial resources for the buyout will be sourced—company reserves, loans, or member contributions.

Right of First Refusal: This clause ensures existing members can buy the departing member's interest before external buyers. It maintains control within the group.

Dispute Resolution Mechanisms: This anticipates conflicts and outlines resolution methods like mediation or arbitration to keep the performance harmonious even in disagreement.

Envisioning Buyout Scenarios: An Example of a Buyout Clause

Consider the following example of a buyout clause within an LLC Buyout Agreement:

"If Member A chooses to exit the company voluntarily, the remaining members shall have the right of first refusal to purchase Member A's ownership interest. The value of the ownership interest shall be determined using the fair market value as assessed by an independent third-party appraiser. The purchasing members shall have the option to pay the agreed-upon purchase price in a lump sum or through structured payments over a period of [specified time]."

Benefits of an LLC Buyout Agreement

A buyout agreement holds a myriad of benefits that contribute to the well-being and continuity of an LLC:

1. Seamless Ownership Transitions:

An LLC Buyout Agreement ensures that ownership transitions occur without disrupting business operations. It offers a well-defined pathway for the transfer of ownership interests. This agreement acts as a meticulously planned route, guiding the transfer of ownership interests from one member to another without causing disruptions to the ongoing business operations. It's akin to having a well-marked path that leads to a harmonious transition of power.

2. Conflict Mitigation: In the world of business, conflicts can arise unexpectedly. The LLC Buyout Agreement acts as a shield against these potential conflicts. By establishing clear terms, conditions, and procedures for buyouts in advance, the agreement functions as a preventative measure, reducing the risk of disputes and disagreements among members. It's like fortifying the structure of a building to withstand the forces of nature.

3. Preservation of Business Relationships: This agreement provides a framework for amicable and structured negotiations during buyouts. It allows members to part ways while preserving positive relationships. Just as travellers might choose different paths, business partners can separate on good terms, thanks to the structured guidance of the agreement.

4. Certainty in Valuation: The agreement clarifies how ownership interests are valued, reducing ambiguity and potential disputes over pricing. By clarifying the methods and criteria for valuing these interests, the agreement eliminates ambiguity and potential disputes over pricing. It's like having a reliable compass that points toward a fair and agreed-upon value.

5. Protection of Interests: The buyout agreement safeguards the interests of all parties involved. It ensures that the buyout process is equitable, transparent, and just for departing and remaining members alike. This protection extends to both financial and relational aspects, fostering an environment of trust and integrity. In essence, the agreement acts as a shield that upholds the principles of fairness and respect.

An LLC Buyout Agreement functions as a compass, a shield, and a roadmap all rolled into one. It not only guides the company through transitions, but also shields it from potential conflicts, and provides a roadmap for maintaining strong relationships. This multifaceted tool ensures that ownership changes are conducted smoothly, fairly, and in a manner that safeguards the essence of the business.

Why You Should Use an LLC Buyout Agreement Template

Utilizing an LLC Buyout Agreement template offers several compelling advantages when dealing with the transition of ownership interests within a Limited Liability Company (LLC):

1. Customization:

Templates provide a structured framework that can be easily customized to suit your specific needs. You can adapt the terms, conditions, and provisions to align with the unique circumstances of the LLC and the parties involved in the buyout.

2. Clarity:

A template helps ensure that all relevant aspects of the buyout are clearly defined, including the buyout price, payment terms, valuation methods, and any contingencies. This clarity reduces the risk of misunderstandings or disputes arising during the buyout process.

3. Time and Cost Efficiency:

Creating a buyout agreement from scratch can be time-consuming and expensive if legal assistance is required. Using a template saves both time and money while still delivering a professionally structured document.

4. Legal Compliance:

A well-crafted template is likely to include standard legal language and clauses that address various legal considerations. This reduces the chances of overlooking essential legal requirements and minimizes potential legal complications.

5. Conflict Resolution:

The template can outline procedures for resolving conflicts that may arise during the buyout process, helping to manage disagreements between parties and maintain a smooth transition.

6. Exit Strategy:

An LLC Partner Buyout Agreement template can serve as part of your business's exit strategy, ensuring that there's a clear plan in place for the orderly transfer of ownership interests in the event of an owner's departure, retirement, or other circumstances.

7. Consistency:

If your business engages in multiple buyout transactions, using a template ensures consistency across agreements, making it easier to manage and track various buyout processes.

8. Documentation:

The template serves as an essential record of the buyout terms and conditions. This documentation can be invaluable in the future, especially if disputes arise or if parties need to review the agreement's terms.

9. Protection of Interests:

By outlining the specifics of the buyout process, a template helps protect the interests of all parties involved, including remaining members, departing members, and the company itself.

10. Professionalism:

Utilizing a well-designed template demonstrates professionalism and seriousness in handling the buyout. It instills confidence in all parties that the transaction is being conducted in a thorough and legitimate manner.

While templates offer many benefits, they should be reviewed and customized to fit the specific context of your LLC and the buyout situation. If there are complex or unique elements involved, seeking legal advice is advisable to ensure the agreement aligns with applicable laws and regulations.

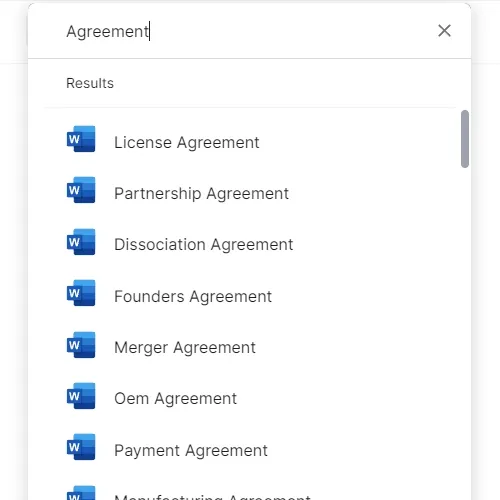

Within Business in a Box, you'll discover a range of legal agreements and contracts templates designed to optimize business operations. Alongside the LLC Buyout Agreement, our collection also includes similar templates and LLC Operating Agreements like the Buyout Agreement, Partnership Buyout Agreement,LLC Member Withdrawal Agreement, LLC Investment Agreement and LLC Membership Interest Purchase Agreement.

FAQs about LLC Buyout Agreements

1. What is a Buyout Contract?

A buyout contract, also known as a buyout agreement or buy-sell agreement, is a legally binding agreement that outlines the procedures, terms, and conditions for purchasing a departing member's ownership interest within an LLC. It serves as a roadmap for ownership transitions and ensures a smooth transfer of ownership.

2. Why Would a Company Offer a Buyout?

Companies offer buyouts to facilitate ownership transitions, often due to a member's voluntary exit, retirement, incapacitation, or other triggering events. A buyout provides a structured way for members to exit the business while maintaining the company's operational stability.

3. What is a Typical Buyout Offer?

A typical buyout offer encompasses various factors, including the valuation method used to determine the departing member's ownership interest, the compensation mechanism (such as lump-sum payment or structured payments), the funding arrangements, and any conditions or triggers that initiate the buyout process. The specifics of a buyout offer depend on the agreement's terms and the unique circumstances of the LLC.

4. Can I Create My Own LLC Buyout Agreement?

Creating your own LLC Buyout Agreement is feasible, but it's advisable to seek legal counsel, especially when dealing with intricate valuation methods, funding arrangements, and potential legal considerations. Utilizing an LLC Member Buyout Agreement Template can provide a foundation, but customization and legal review are crucial to ensure the agreement aligns with state laws and the LLC's specific requirements.

Conclusion

An LLC Buyout Agreement is an indispensable tool contributing to the cohesion, continuity, and fairness within a Limited Liability Company. By offering a strategic framework for ownership transitions, these LLC Operating Agreements ensure that business operations remain intact while preserving the interests of all stakeholders. It's a testament to the proactive approach of businesses in preparing for potential changes and a reflection of their commitment to maintaining a harmonious and thriving entrepreneurial journey.

Reviewed on

Understanding an Exclusive Partnership Agreement

An LLC Buyout Agreement stands as a cornerstone document that safeguards the interests of members within a Limited Liability Company (LLC) by outlining procedures and provisions for the buyout of a departing member's ownership stake. Like most LLC Operating Agreements, this comprehensive agreement serves as a protective shield against uncertainties that may arise during ownership transitions and facilitates the seamless continuation of business operations. In this article, we'll delve into the intricacies of an LLC Buyout Agreement, explore its importance for business sustainability, and shed light on key questions surrounding its components, implications, and advantages.

Exploring the Landscape of an LLC Buyout Agreement

An LLC Buyout Agreement stands as a strategic pact that casts aguiding light on the path to be taken when a member of a LimitedLiability Company (LLC) opts to withdraw from the company. Withinthe contours of this comprehensive agreement lie intricately woventhreads that encompass pivotal details: from the intricatevaluation of the departing member's ownership interest to themechanics of compensation, all enveloped within the protectiveembrace of a meticulously constructed legal framework. Thisagreement, akin to a well-crafted blueprint, deftly erects apre-defined roadmap, steering the course of buyout scenarios whileadeptly minimizing potential conflicts, illuminating clarity, andfurnishing a robust framework for realizing equitable resolutions.

Decoding the Components of an LLC Buyout Agreement

At the core of an LLC Buyout Agreement, crucial components form a cohesive structure that guides a seamless transition of ownership. These interlinked elements work together to create a well-organized agreement, benefiting all stakeholders:

Valuation Methodology: At the core of the agreement lies the method used to determine the departing member's ownership interest. This method could involve book value, fair market value, or agreed-upon formulas, all contributing to transparency and a fair price.

Buyout Triggers: This aspect takes center stage, outlining scenarios that lead to a buyout—retirement, resignation, incapacitation, or voluntary exit. It serves as a guiding star for ownership transitions.

Buyout Process: Within the agreement, the buyout process is a carefully choreographed sequence. It defines the timeline, communication rules, and roles of the departing and remaining members.

Compensation Mechanism: The compensation section reveals how the departing member will be paid. This could be a lump sum, installment plans, or structured payments over time.

Funding Arrangements: Funding is prominent, detailing how financial resources for the buyout will be sourced—company reserves, loans, or member contributions.

Right of First Refusal: This clause ensures existing members can buy the departing member's interest before external buyers. It maintains control within the group.

Dispute Resolution Mechanisms: This anticipates conflicts and outlines resolution methods like mediation or arbitration to keep the performance harmonious even in disagreement.

Envisioning Buyout Scenarios: An Example of a Buyout Clause

Consider the following example of a buyout clause within an LLC Buyout Agreement:

"If Member A chooses to exit the company voluntarily, the remaining members shall have the right of first refusal to purchase Member A's ownership interest. The value of the ownership interest shall be determined using the fair market value as assessed by an independent third-party appraiser. The purchasing members shall have the option to pay the agreed-upon purchase price in a lump sum or through structured payments over a period of [specified time]."

Benefits of an LLC Buyout Agreement

A buyout agreement holds a myriad of benefits that contribute to the well-being and continuity of an LLC:

1. Seamless Ownership Transitions:

An LLC Buyout Agreement ensures that ownership transitions occur without disrupting business operations. It offers a well-defined pathway for the transfer of ownership interests. This agreement acts as a meticulously planned route, guiding the transfer of ownership interests from one member to another without causing disruptions to the ongoing business operations. It's akin to having a well-marked path that leads to a harmonious transition of power.

2. Conflict Mitigation: In the world of business, conflicts can arise unexpectedly. The LLC Buyout Agreement acts as a shield against these potential conflicts. By establishing clear terms, conditions, and procedures for buyouts in advance, the agreement functions as a preventative measure, reducing the risk of disputes and disagreements among members. It's like fortifying the structure of a building to withstand the forces of nature.

3. Preservation of Business Relationships: This agreement provides a framework for amicable and structured negotiations during buyouts. It allows members to part ways while preserving positive relationships. Just as travellers might choose different paths, business partners can separate on good terms, thanks to the structured guidance of the agreement.

4. Certainty in Valuation: The agreement clarifies how ownership interests are valued, reducing ambiguity and potential disputes over pricing. By clarifying the methods and criteria for valuing these interests, the agreement eliminates ambiguity and potential disputes over pricing. It's like having a reliable compass that points toward a fair and agreed-upon value.

5. Protection of Interests: The buyout agreement safeguards the interests of all parties involved. It ensures that the buyout process is equitable, transparent, and just for departing and remaining members alike. This protection extends to both financial and relational aspects, fostering an environment of trust and integrity. In essence, the agreement acts as a shield that upholds the principles of fairness and respect.

An LLC Buyout Agreement functions as a compass, a shield, and a roadmap all rolled into one. It not only guides the company through transitions, but also shields it from potential conflicts, and provides a roadmap for maintaining strong relationships. This multifaceted tool ensures that ownership changes are conducted smoothly, fairly, and in a manner that safeguards the essence of the business.

Why You Should Use an LLC Buyout Agreement Template

Utilizing an LLC Buyout Agreement template offers several compelling advantages when dealing with the transition of ownership interests within a Limited Liability Company (LLC):

1. Customization:

Templates provide a structured framework that can be easily customized to suit your specific needs. You can adapt the terms, conditions, and provisions to align with the unique circumstances of the LLC and the parties involved in the buyout.

2. Clarity:

A template helps ensure that all relevant aspects of the buyout are clearly defined, including the buyout price, payment terms, valuation methods, and any contingencies. This clarity reduces the risk of misunderstandings or disputes arising during the buyout process.

3. Time and Cost Efficiency:

Creating a buyout agreement from scratch can be time-consuming and expensive if legal assistance is required. Using a template saves both time and money while still delivering a professionally structured document.

4. Legal Compliance:

A well-crafted template is likely to include standard legal language and clauses that address various legal considerations. This reduces the chances of overlooking essential legal requirements and minimizes potential legal complications.

5. Conflict Resolution:

The template can outline procedures for resolving conflicts that may arise during the buyout process, helping to manage disagreements between parties and maintain a smooth transition.

6. Exit Strategy:

An LLC Partner Buyout Agreement template can serve as part of your business's exit strategy, ensuring that there's a clear plan in place for the orderly transfer of ownership interests in the event of an owner's departure, retirement, or other circumstances.

7. Consistency:

If your business engages in multiple buyout transactions, using a template ensures consistency across agreements, making it easier to manage and track various buyout processes.

8. Documentation:

The template serves as an essential record of the buyout terms and conditions. This documentation can be invaluable in the future, especially if disputes arise or if parties need to review the agreement's terms.

9. Protection of Interests:

By outlining the specifics of the buyout process, a template helps protect the interests of all parties involved, including remaining members, departing members, and the company itself.

10. Professionalism:

Utilizing a well-designed template demonstrates professionalism and seriousness in handling the buyout. It instills confidence in all parties that the transaction is being conducted in a thorough and legitimate manner.

While templates offer many benefits, they should be reviewed and customized to fit the specific context of your LLC and the buyout situation. If there are complex or unique elements involved, seeking legal advice is advisable to ensure the agreement aligns with applicable laws and regulations.

Within Business in a Box, you'll discover a range of legal agreements and contracts templates designed to optimize business operations. Alongside the LLC Buyout Agreement, our collection also includes similar templates and LLC Operating Agreements like the Buyout Agreement, Partnership Buyout Agreement,LLC Member Withdrawal Agreement, LLC Investment Agreement and LLC Membership Interest Purchase Agreement.

FAQs about LLC Buyout Agreements

1. What is a Buyout Contract?

A buyout contract, also known as a buyout agreement or buy-sell agreement, is a legally binding agreement that outlines the procedures, terms, and conditions for purchasing a departing member's ownership interest within an LLC. It serves as a roadmap for ownership transitions and ensures a smooth transfer of ownership.

2. Why Would a Company Offer a Buyout?

Companies offer buyouts to facilitate ownership transitions, often due to a member's voluntary exit, retirement, incapacitation, or other triggering events. A buyout provides a structured way for members to exit the business while maintaining the company's operational stability.

3. What is a Typical Buyout Offer?

A typical buyout offer encompasses various factors, including the valuation method used to determine the departing member's ownership interest, the compensation mechanism (such as lump-sum payment or structured payments), the funding arrangements, and any conditions or triggers that initiate the buyout process. The specifics of a buyout offer depend on the agreement's terms and the unique circumstances of the LLC.

4. Can I Create My Own LLC Buyout Agreement?

Creating your own LLC Buyout Agreement is feasible, but it's advisable to seek legal counsel, especially when dealing with intricate valuation methods, funding arrangements, and potential legal considerations. Utilizing an LLC Member Buyout Agreement Template can provide a foundation, but customization and legal review are crucial to ensure the agreement aligns with state laws and the LLC's specific requirements.

Conclusion

An LLC Buyout Agreement is an indispensable tool contributing to the cohesion, continuity, and fairness within a Limited Liability Company. By offering a strategic framework for ownership transitions, these LLC Operating Agreements ensure that business operations remain intact while preserving the interests of all stakeholders. It's a testament to the proactive approach of businesses in preparing for potential changes and a reflection of their commitment to maintaining a harmonious and thriving entrepreneurial journey.

Easily Create Any Business Document You Need in Minutes.

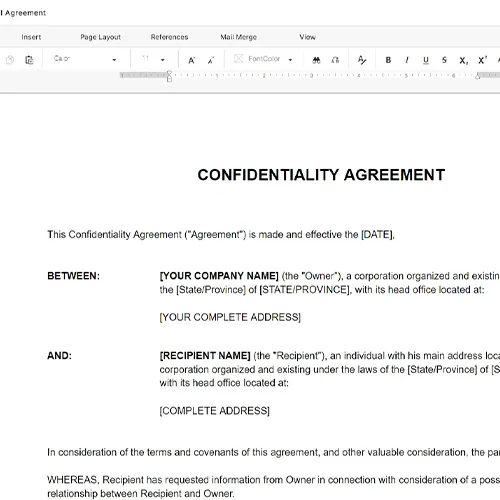

Download or open template

Access over 3,000+ business and legal templates for any business task, project or initiative.

Edit and fill in the blanks

Customize your ready-made business document template and save it in the cloud.

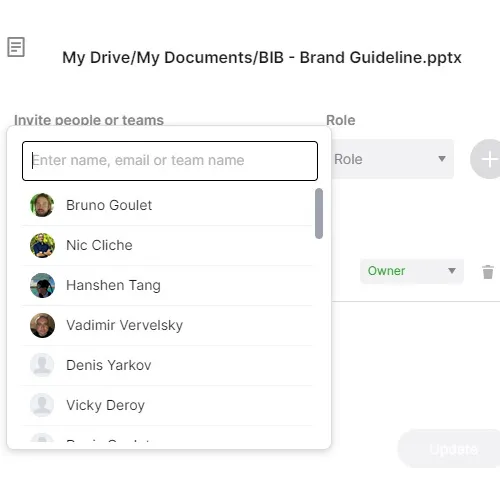

Save, Share, Export, or Sign

Share your files and folders with your team. Create a space of seamless collaboration.