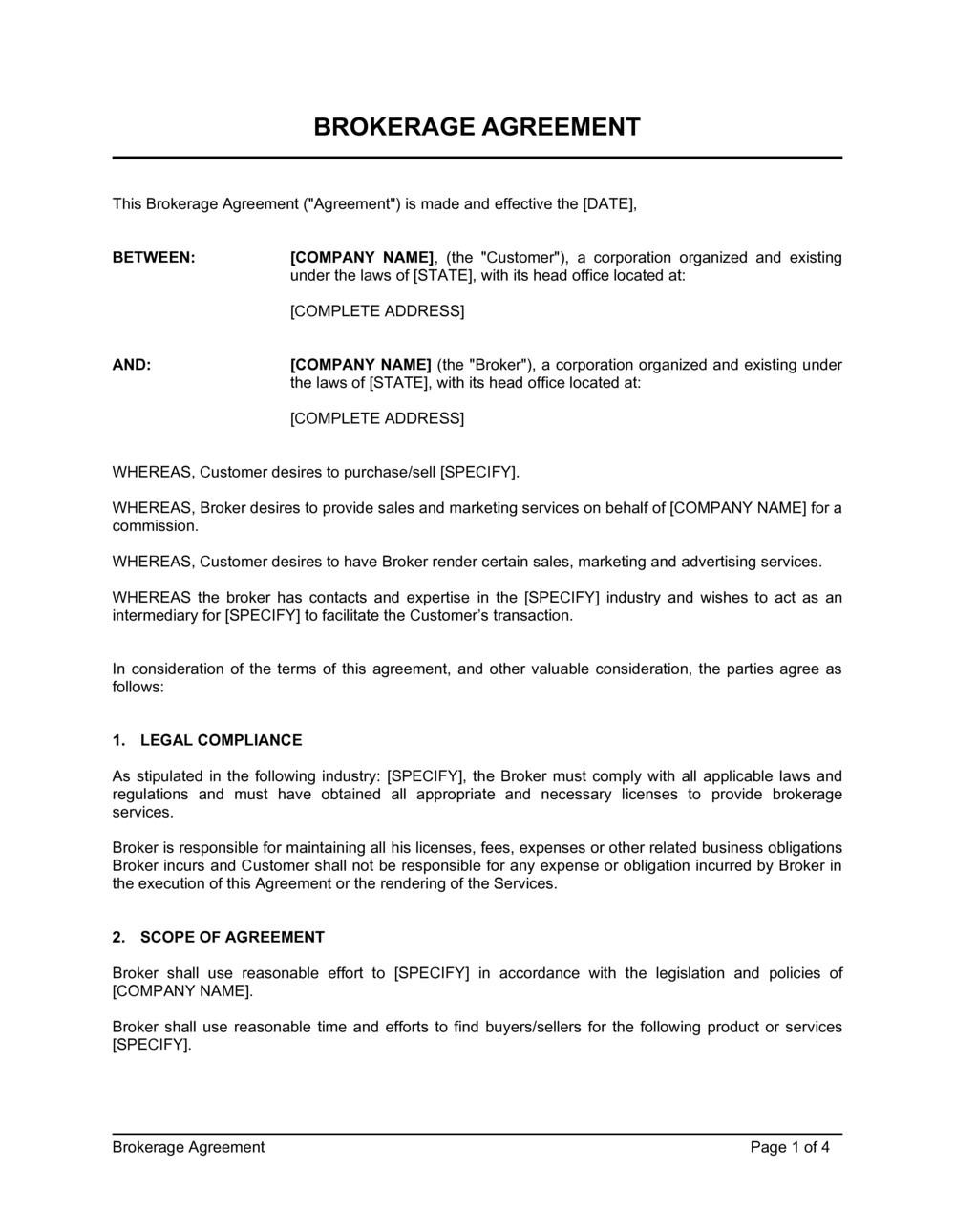

Brokerage Agreement Template

Understanding Brokerage Agreements

Brokerage agreements are contractual agreements between a broker and a client that outline the terms and conditions under which the broker will provide brokerage services. These agreements are essential in facilitating transactions in various financial markets, such as stocks, bonds, commodities, and real estate. Understanding the key components and considerations of brokerage agreements is crucial for both brokers and clients to ensure a mutually beneficial and legally compliant relationship. In this article, we will delve into the details of brokerage agreements, their importance, and provide guidance on understanding and negotiating these agreements effectively.

What is a Brokerage Agreement?

A brokerage agreement, also known as a brokerage contract or client agreement, is a legally binding document that establishes the relationship between a broker or brokerage firm and a client. It sets forth the terms and conditions under which the broker will provide services, including buying and selling securities or other financial instruments on behalf of the client. The agreement typically covers areas such as the scope of services, fees and commissions, responsibilities of both parties, confidentiality, and dispute resolution mechanisms.

Importance of Brokerage Agreements

Brokerage agreements serve several crucial purposes for both brokers and clients:

- Clarity and Understanding: A well-drafted brokerage agreement provides clarity and ensures that both parties have a clear understanding of their rights, obligations, and the scope of services to be provided. It helps prevent misunderstandings and potential disputes by establishing a common understanding from the outset.

- Legal Compliance: Brokerage agreements help ensure compliance with relevant laws and regulations governing the brokerage industry. These agreements outline the legal obligations of both the broker and the client, including the duty to act in the client's best interest, proper handling of client funds, and adherence to anti-money laundering and know-your-customer regulations.

- Risk Management: Brokerage agreements often include provisions related to risk disclosure and disclaimers. These provisions inform clients about the risks associated with investing or trading in financial markets and may require clients to acknowledge and accept such risks. By clearly outlining the risks involved, brokerage agreements help manage expectations and minimize the potential for disputes or liability.

- Fee Structure and Compensation: The agreement outlines the fees, commissions, or other compensation arrangements between the broker and the client. This includes details about the broker's commission structure, any additional charges or expenses, and how these fees will be calculated and paid. Clear fee provisions help prevent misunderstandings and ensure fair compensation for the broker's services.

- Confidentiality and Privacy: Brokerage agreements often include confidentiality provisions to protect the client's personal and financial information. These provisions outline the broker's responsibilities to safeguard client data and restrict the use or disclosure of confidential information except as required by law or with the client's consent.

- Dispute Resolution: Brokerage agreements typically include clauses related to dispute resolution, such as arbitration or mediation. These provisions establish mechanisms for resolving disputes that may arise between the broker and the client, offering an alternative to litigation and potentially reducing costs and delays.

Key Components of a Brokerage Agreement

While the specific terms and provisions of brokerage agreements can vary depending on the broker, the type of services offered, and the jurisdiction, several key components are commonly found in these agreements:

- Parties: The agreement should clearly identify the broker or brokerage firm and the client by their legal names. This section may also include contact information and any relevant licensing or registration details.

- Scope of Services: The agreement should describe the services to be provided by the broker, including the types of investments or transactions the broker is authorized to undertake on behalf of the client. It should also outline any limitations or restrictions on the broker's activities.

- Fees and Commissions: The agreement should specify the fees, commissions, or other compensation arrangements between the broker and the client. It should detail how these fees will be calculated, when they are payable, and any additional charges or expenses that may be incurred.

- Responsibilities and Duties: The agreement should outline the responsibilities and duties of both the broker and the client. This may include the broker's duty to act in the client's best interest, the client's obligation to provide accurate information, and any reporting requirements.

- Duration and Termination: The agreement should specify the duration of the relationship and the conditions under which either party can terminate the agreement. This may include notice periods, termination fees, or other provisions related to the termination process.

- Risk Disclosure: The agreement should include a section that clearly discloses the risks associated with investing or trading in financial markets. This section may outline the potential risks, such as market volatility, liquidity risks, or the risk of loss of principal, and require the client's acknowledgment and acceptance of these risks.

- Confidentiality and Privacy: The agreement should address the confidentiality and privacy obligations of the broker. It should outline the broker's responsibilities to protect the client's personal and financial information and any exceptions or circumstances in which disclosure may be required.

- Dispute Resolution: The agreement should include a clause that outlines the mechanism for resolving disputes, such as arbitration or mediation. This section may specify the applicable rules and procedures for dispute resolution and the jurisdiction governing the agreement.

Negotiating a Brokerage Agreement

Negotiating a brokerage agreement requires careful consideration of the terms and provisions that are most important to both parties. Here are some key points to keep in mind during the negotiation process:

- Understand Your Needs: Before entering into negotiations, clearly define your needs, expectations, and objectives. Consider factors such as the type of investments or services required, the level of support and communication expected from the broker, and any specific preferences or concerns.

- Research and Compare: Conduct thorough research to understand the prevailing market practices, fees, and services offered by different brokers. This will enable you to compare and evaluate the terms proposed by different brokers and negotiate from a position of knowledge and understanding.

- Review and Seek Advice: Carefully review the terms and provisions of the brokerage agreement. If necessary, seek advice from legal or financial professionals who can provide guidance and ensure that the agreement meets your needs and complies with relevant laws and regulations.

- Be Clear and Specific: During negotiations, clearly communicate your requirements and expectations to the broker. Be specific about the services, fees, and any additional provisions that are important to you. This will help ensure that the agreement accurately reflects your needs and reduces the potential for misunderstandings.

- Seek Flexibility: While it is important to be clear about your requirements, also be open to negotiations and flexibility. Consider the broker's perspective and constraints, and be willing to find mutually beneficial solutions that address both parties' interests.

- Review and Revise: After initial negotiations, carefully review the draft agreement to ensure that all agreed-upon terms and provisions are accurately reflected. Be prepared to revise the agreement and seek clarification on any ambiguous or unclear provisions.

- Seek Legal Review: Before signing the agreement, consider seeking legal review to ensure that the terms are legally valid, enforceable, and protect your interests. Legal professionals can provide advice on potential risks, suggest modifications, and help negotiate any necessary changes.

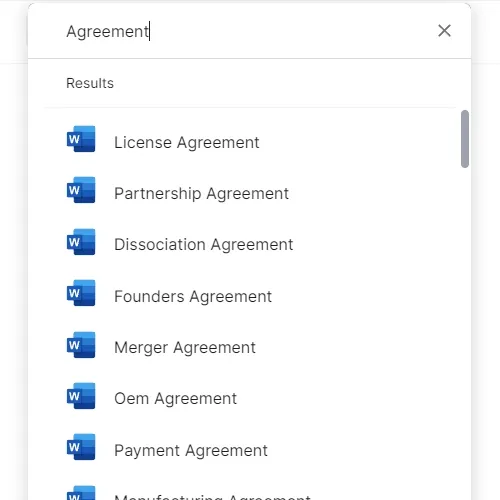

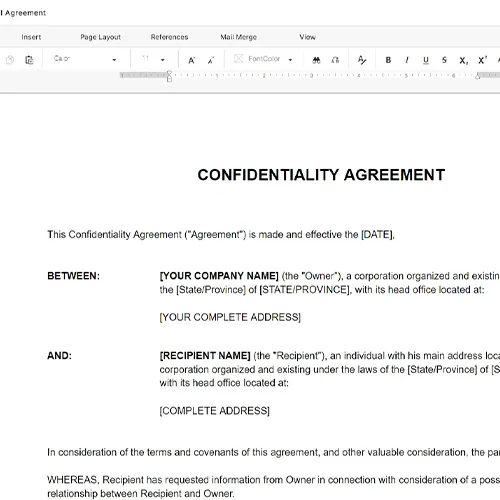

Brokerage Agreement Templates in Business in a Box

Business in a Box is a comprehensive online library of legal and business document templates designed to simplify the process of creating professional documents. It offers a wide range of brokerage agreement templates that cover various scenarios and industries. Some of the most popular brokerage agreements available include, Exclusive Tenant Brokerage Agreement, Artist-Agent Agreement, Sales Agency Agreements, Marketing Agency Agreement and many more.

Conclusion

Understanding brokerage agreements is crucial for both brokers and clients to establish a clear and mutually beneficial relationship. These agreements provide the framework for the provision of brokerage services, define the rights and obligations of both parties, and ensure compliance with applicable laws and regulations. By carefully reviewing, negotiating, and understanding the terms and provisions of brokerage agreements, brokers and clients can establish a solid foundation for their business relationship and mitigate potential risks and disputes.

Reviewed on

Understanding Brokerage Agreements

Brokerage agreements are contractual agreements between a broker and a client that outline the terms and conditions under which the broker will provide brokerage services. These agreements are essential in facilitating transactions in various financial markets, such as stocks, bonds, commodities, and real estate. Understanding the key components and considerations of brokerage agreements is crucial for both brokers and clients to ensure a mutually beneficial and legally compliant relationship. In this article, we will delve into the details of brokerage agreements, their importance, and provide guidance on understanding and negotiating these agreements effectively.

What is a Brokerage Agreement?

A brokerage agreement, also known as a brokerage contract or client agreement, is a legally binding document that establishes the relationship between a broker or brokerage firm and a client. It sets forth the terms and conditions under which the broker will provide services, including buying and selling securities or other financial instruments on behalf of the client. The agreement typically covers areas such as the scope of services, fees and commissions, responsibilities of both parties, confidentiality, and dispute resolution mechanisms.

Importance of Brokerage Agreements

Brokerage agreements serve several crucial purposes for both brokers and clients:

- Clarity and Understanding: A well-drafted brokerage agreement provides clarity and ensures that both parties have a clear understanding of their rights, obligations, and the scope of services to be provided. It helps prevent misunderstandings and potential disputes by establishing a common understanding from the outset.

- Legal Compliance: Brokerage agreements help ensure compliance with relevant laws and regulations governing the brokerage industry. These agreements outline the legal obligations of both the broker and the client, including the duty to act in the client's best interest, proper handling of client funds, and adherence to anti-money laundering and know-your-customer regulations.

- Risk Management: Brokerage agreements often include provisions related to risk disclosure and disclaimers. These provisions inform clients about the risks associated with investing or trading in financial markets and may require clients to acknowledge and accept such risks. By clearly outlining the risks involved, brokerage agreements help manage expectations and minimize the potential for disputes or liability.

- Fee Structure and Compensation: The agreement outlines the fees, commissions, or other compensation arrangements between the broker and the client. This includes details about the broker's commission structure, any additional charges or expenses, and how these fees will be calculated and paid. Clear fee provisions help prevent misunderstandings and ensure fair compensation for the broker's services.

- Confidentiality and Privacy: Brokerage agreements often include confidentiality provisions to protect the client's personal and financial information. These provisions outline the broker's responsibilities to safeguard client data and restrict the use or disclosure of confidential information except as required by law or with the client's consent.

- Dispute Resolution: Brokerage agreements typically include clauses related to dispute resolution, such as arbitration or mediation. These provisions establish mechanisms for resolving disputes that may arise between the broker and the client, offering an alternative to litigation and potentially reducing costs and delays.

Key Components of a Brokerage Agreement

While the specific terms and provisions of brokerage agreements can vary depending on the broker, the type of services offered, and the jurisdiction, several key components are commonly found in these agreements:

- Parties: The agreement should clearly identify the broker or brokerage firm and the client by their legal names. This section may also include contact information and any relevant licensing or registration details.

- Scope of Services: The agreement should describe the services to be provided by the broker, including the types of investments or transactions the broker is authorized to undertake on behalf of the client. It should also outline any limitations or restrictions on the broker's activities.

- Fees and Commissions: The agreement should specify the fees, commissions, or other compensation arrangements between the broker and the client. It should detail how these fees will be calculated, when they are payable, and any additional charges or expenses that may be incurred.

- Responsibilities and Duties: The agreement should outline the responsibilities and duties of both the broker and the client. This may include the broker's duty to act in the client's best interest, the client's obligation to provide accurate information, and any reporting requirements.

- Duration and Termination: The agreement should specify the duration of the relationship and the conditions under which either party can terminate the agreement. This may include notice periods, termination fees, or other provisions related to the termination process.

- Risk Disclosure: The agreement should include a section that clearly discloses the risks associated with investing or trading in financial markets. This section may outline the potential risks, such as market volatility, liquidity risks, or the risk of loss of principal, and require the client's acknowledgment and acceptance of these risks.

- Confidentiality and Privacy: The agreement should address the confidentiality and privacy obligations of the broker. It should outline the broker's responsibilities to protect the client's personal and financial information and any exceptions or circumstances in which disclosure may be required.

- Dispute Resolution: The agreement should include a clause that outlines the mechanism for resolving disputes, such as arbitration or mediation. This section may specify the applicable rules and procedures for dispute resolution and the jurisdiction governing the agreement.

Negotiating a Brokerage Agreement

Negotiating a brokerage agreement requires careful consideration of the terms and provisions that are most important to both parties. Here are some key points to keep in mind during the negotiation process:

- Understand Your Needs: Before entering into negotiations, clearly define your needs, expectations, and objectives. Consider factors such as the type of investments or services required, the level of support and communication expected from the broker, and any specific preferences or concerns.

- Research and Compare: Conduct thorough research to understand the prevailing market practices, fees, and services offered by different brokers. This will enable you to compare and evaluate the terms proposed by different brokers and negotiate from a position of knowledge and understanding.

- Review and Seek Advice: Carefully review the terms and provisions of the brokerage agreement. If necessary, seek advice from legal or financial professionals who can provide guidance and ensure that the agreement meets your needs and complies with relevant laws and regulations.

- Be Clear and Specific: During negotiations, clearly communicate your requirements and expectations to the broker. Be specific about the services, fees, and any additional provisions that are important to you. This will help ensure that the agreement accurately reflects your needs and reduces the potential for misunderstandings.

- Seek Flexibility: While it is important to be clear about your requirements, also be open to negotiations and flexibility. Consider the broker's perspective and constraints, and be willing to find mutually beneficial solutions that address both parties' interests.

- Review and Revise: After initial negotiations, carefully review the draft agreement to ensure that all agreed-upon terms and provisions are accurately reflected. Be prepared to revise the agreement and seek clarification on any ambiguous or unclear provisions.

- Seek Legal Review: Before signing the agreement, consider seeking legal review to ensure that the terms are legally valid, enforceable, and protect your interests. Legal professionals can provide advice on potential risks, suggest modifications, and help negotiate any necessary changes.

Brokerage Agreement Templates in Business in a Box

Business in a Box is a comprehensive online library of legal and business document templates designed to simplify the process of creating professional documents. It offers a wide range of brokerage agreement templates that cover various scenarios and industries. Some of the most popular brokerage agreements available include, Exclusive Tenant Brokerage Agreement, Artist-Agent Agreement, Sales Agency Agreements, Marketing Agency Agreement and many more.

Conclusion

Understanding brokerage agreements is crucial for both brokers and clients to establish a clear and mutually beneficial relationship. These agreements provide the framework for the provision of brokerage services, define the rights and obligations of both parties, and ensure compliance with applicable laws and regulations. By carefully reviewing, negotiating, and understanding the terms and provisions of brokerage agreements, brokers and clients can establish a solid foundation for their business relationship and mitigate potential risks and disputes.

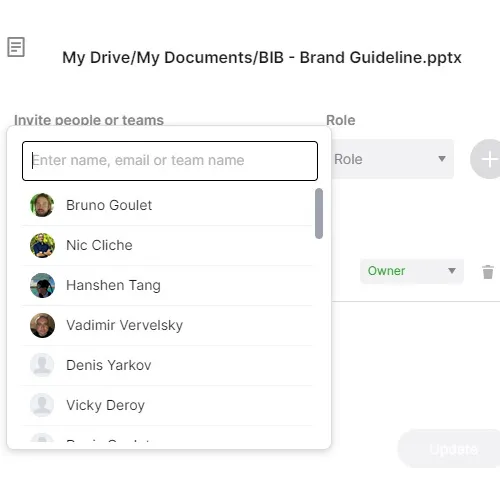

Easily Create Any Business Document You Need in Minutes.

Download or open template

Access over 3,000+ business and legal templates for any business task, project or initiative.

Edit and fill in the blanks

Customize your ready-made business document template and save it in the cloud.

Save, Share, Export, or Sign

Share your files and folders with your team. Create a space of seamless collaboration.