Simple Agreement For Future Equity Safe Template

Document content

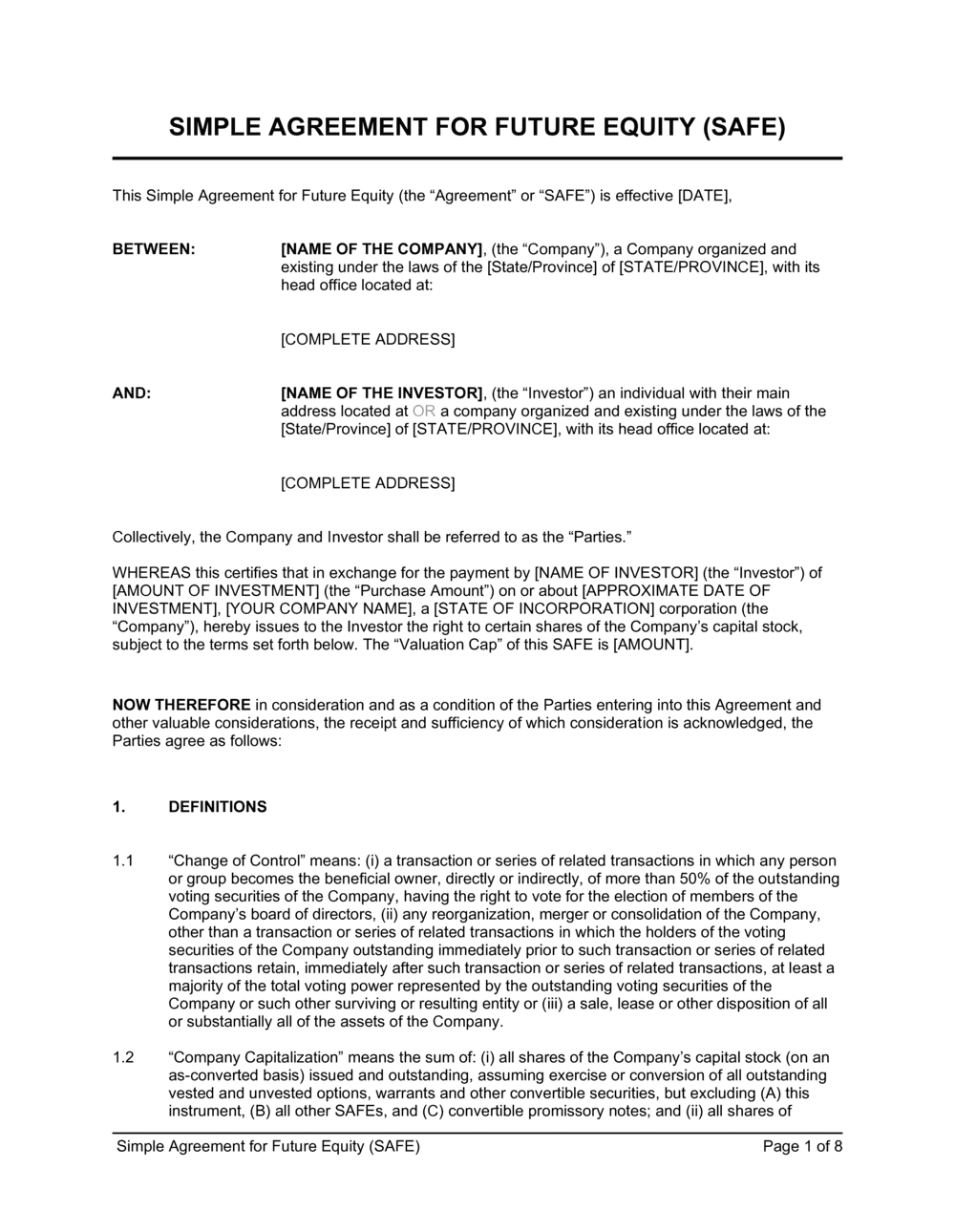

This simple agreement for future equity safe template has 8 pages and is a MS Word file type listed under our business plan kit documents.

Sample of our simple agreement for future equity safe template:

SIMPLE AGREEMENT FOR FUTURE EQUITY (SAFE) This Simple Agreement for Future Equity (the "Agreement" or "SAFE") is effective [DATE], BETWEEN: [NAME OF THE COMPANY], (the "Company"), a Company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [COMPLETE ADDRESS] AND: [NAME OF THE INVESTOR], (the "Investor") an individual with their main address located at OR a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [COMPLETE ADDRESS] Collectively, the Company and Investor shall be referred to as the "Parties." WHEREAS this certifies that in exchange for the payment by [NAME OF INVESTOR] (the "Investor") of [AMOUNT OF INVESTMENT] (the "Purchase Amount") on or about [APPROXIMATE DATE OF INVESTMENT], [YOUR COMPANY NAME], a [STATE OF INCORPORATION] corporation (the "Company"), hereby issues to the Investor the right to certain shares of the Company's capital stock, subject to the terms set forth below. The "Valuation Cap" of this SAFE is [AMOUNT]. NOW THEREFORE in consideration and as a condition of the Parties entering into this Agreement and other valuable considerations, the receipt and sufficiency of which consideration is acknowledged, the Parties agree as follows: DEFINITIONS "Change of Control" means: (i) a transaction or series of related transactions in which any person or group becomes the beneficial owner, directly or indirectly, of more than 50% of the outstanding voting securities of the Company, having the right to vote for the election of members of the Company's board of directors, (ii) any reorganization, merger or consolidation of the Company, other than a transaction or series of related transactions in which the holders of the voting securities of the Company outstanding immediately prior to such transaction or series of related transactions retain, immediately after such transaction or series of related transactions, at least a majority of the total voting power represented by the outstanding voting securities of the Company or such other surviving or resulting entity or (iii) a sale, lease or other disposition of all or substantially all of the assets of the Company. "Company Capitalization" means the sum of: (i) all shares of the Company's capital stock (on an as-converted basis) issued and outstanding, assuming exercise or conversion of all outstanding vested and unvested options, warrants and other convertible securities, but excluding (A) this instrument, (B) all other SAFEs, and (C) convertible promissory notes; and (ii) all shares of Common Stock reserved and available for future grant under any equity incentive or similar plan of the Company, including any equity incentive or similar plan created or increased in connection with the Equity Financing. "Common Stock" means the common stock of the Company. "Distribution" means the transfer to holders of the Company's capital stock by reason of their ownership of such stock of cash or other property without consideration, whether by way of dividend or otherwise, other than dividends on the Common Stock payable in Common Stock, or the purchase or redemption of shares of the Company by the Company or its subsidiaries for cash or property other than: (i) repurchases of the Common Stock issued to or held by employees, officers, directors or consultants of the Company or its subsidiaries upon termination of their employment or services pursuant to agreements providing for the right of said repurchase, (ii) repurchases of Common Stock issued to or held by employees, officers, directors or consultants of the Company or its subsidiaries pursuant to rights of first refusal contained in agreements providing for such right, and (iii) repurchases of capital stock of the Company in connection with the settlement of disputes with any stockholder. "Dissolution Event" means: (i) a voluntary termination of operations, (ii) a general assignment for the benefit of the Company's creditors, or (iii) any other liquidation, dissolution or winding up of the Company (excluding a Liquidity Event), whether voluntary or involuntary. "Equity Financing" means a bona fide transaction or series of transactions with the principal purpose of raising capital, pursuant to which the Company issues and sells shares of preferred stock of the Company at a fixed pre-money valuation. "Initial Public Offering" means the closing of the Company's first firm commitment underwritten initial public offering of the Common Stock pursuant to a registration statement filed under the Securities Act of [STATE/PROVINCE], as amended (the "Securities Act"). "Liquidity Capitalization" means all shares of the Company's capital stock (on an as-converted basis) issued and outstanding, assuming exercise or conversion of all outstanding vested and unvested options, warrants and other convertible securities, but excluding (i) all shares of the Common Stock reserved and available for future grant under any equity incentive or similar plan of the Company; (ii) this instrument, (iii) all other SAFEs, and (iv) convertible promissory notes. "Liquidity Event" means a Change of Control or an Initial Public Offering. "Liquidity Price" means the price per share equal to the quotient obtained by dividing (i) the Valuation Cap by (ii) the Liquidity Capitalization as of immediately prior to the Liquidity Event. "Pro Rata Rights Agreement" means a written agreement between the Company and the Investor (and holders of other SAFEs, as appropriate) giving the Investor a right to purchase its pro rata share of private placements of securities by the Company occurring after the Equity Financing, subject to customary exceptions. Pro rata for purposes of the Pro Rata Rights Agreement will be calculated based on the ratio of (a) the number of shares of capital stock of the Company owned by the Investor immediately prior to the issuance of the securities to (b) the total number of shares of outstanding capital stock of the Company on a fully diluted basis, calculated as of immediately prior to the issuance of the securities. "SAFE" means an instrument containing a future right to the Company's capital stock, similar in form and content to this instrument, purchased by investors for the purpose of funding the Company's business operations. "SAFE Preferred Stock" means the shares of a series of the Company's preferred stock issued to the Investor in an Equity Financing, which will have the identical rights, privileges, preferences and restrictions as the shares of Standard Preferred Stock, other than with respect to the per share liquidation preference, which will equal the SAFE Price or the Discount Price (as applicable), as well as price-based anti-dilution protection and dividend rights, which will be based on such SAFE Price or the Discount Price (as applicable). "SAFE Price" means the price per share equal to the quotient obtained by dividing (i) the Valuation Cap by (ii) either (A) the Company Capitalization as of immediately prior to the Equity Financing or (B) the capitalization of the Company used to calculate the price per share of the Standard Preferred Stock, whichever calculation results in a lower price. "Standard Preferred Stock" means the shares of a series of the Company's preferred stock issued to the investors investing new money in the Company in connection with the initial closing of the Equity Financing. EQUITY FINANCING EVENT If there is an Equity Financing Event before the expiration or termination of this instrument, the Company will automatically issue to the Investor either: a number of shares of Standard Preferred Stock sold in the Equity Financing equal to the Purchase Amount divided by the price per share of the Standard Preferred Stock, if the pre-money valuation is less than or equal to the Valuation Cap; or

Reviewed on

Document content

This simple agreement for future equity safe template has 8 pages and is a MS Word file type listed under our business plan kit documents.

Sample of our simple agreement for future equity safe template:

SIMPLE AGREEMENT FOR FUTURE EQUITY (SAFE) This Simple Agreement for Future Equity (the "Agreement" or "SAFE") is effective [DATE], BETWEEN: [NAME OF THE COMPANY], (the "Company"), a Company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [COMPLETE ADDRESS] AND: [NAME OF THE INVESTOR], (the "Investor") an individual with their main address located at OR a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [COMPLETE ADDRESS] Collectively, the Company and Investor shall be referred to as the "Parties." WHEREAS this certifies that in exchange for the payment by [NAME OF INVESTOR] (the "Investor") of [AMOUNT OF INVESTMENT] (the "Purchase Amount") on or about [APPROXIMATE DATE OF INVESTMENT], [YOUR COMPANY NAME], a [STATE OF INCORPORATION] corporation (the "Company"), hereby issues to the Investor the right to certain shares of the Company's capital stock, subject to the terms set forth below. The "Valuation Cap" of this SAFE is [AMOUNT]. NOW THEREFORE in consideration and as a condition of the Parties entering into this Agreement and other valuable considerations, the receipt and sufficiency of which consideration is acknowledged, the Parties agree as follows: DEFINITIONS "Change of Control" means: (i) a transaction or series of related transactions in which any person or group becomes the beneficial owner, directly or indirectly, of more than 50% of the outstanding voting securities of the Company, having the right to vote for the election of members of the Company's board of directors, (ii) any reorganization, merger or consolidation of the Company, other than a transaction or series of related transactions in which the holders of the voting securities of the Company outstanding immediately prior to such transaction or series of related transactions retain, immediately after such transaction or series of related transactions, at least a majority of the total voting power represented by the outstanding voting securities of the Company or such other surviving or resulting entity or (iii) a sale, lease or other disposition of all or substantially all of the assets of the Company. "Company Capitalization" means the sum of: (i) all shares of the Company's capital stock (on an as-converted basis) issued and outstanding, assuming exercise or conversion of all outstanding vested and unvested options, warrants and other convertible securities, but excluding (A) this instrument, (B) all other SAFEs, and (C) convertible promissory notes; and (ii) all shares of Common Stock reserved and available for future grant under any equity incentive or similar plan of the Company, including any equity incentive or similar plan created or increased in connection with the Equity Financing. "Common Stock" means the common stock of the Company. "Distribution" means the transfer to holders of the Company's capital stock by reason of their ownership of such stock of cash or other property without consideration, whether by way of dividend or otherwise, other than dividends on the Common Stock payable in Common Stock, or the purchase or redemption of shares of the Company by the Company or its subsidiaries for cash or property other than: (i) repurchases of the Common Stock issued to or held by employees, officers, directors or consultants of the Company or its subsidiaries upon termination of their employment or services pursuant to agreements providing for the right of said repurchase, (ii) repurchases of Common Stock issued to or held by employees, officers, directors or consultants of the Company or its subsidiaries pursuant to rights of first refusal contained in agreements providing for such right, and (iii) repurchases of capital stock of the Company in connection with the settlement of disputes with any stockholder. "Dissolution Event" means: (i) a voluntary termination of operations, (ii) a general assignment for the benefit of the Company's creditors, or (iii) any other liquidation, dissolution or winding up of the Company (excluding a Liquidity Event), whether voluntary or involuntary. "Equity Financing" means a bona fide transaction or series of transactions with the principal purpose of raising capital, pursuant to which the Company issues and sells shares of preferred stock of the Company at a fixed pre-money valuation. "Initial Public Offering" means the closing of the Company's first firm commitment underwritten initial public offering of the Common Stock pursuant to a registration statement filed under the Securities Act of [STATE/PROVINCE], as amended (the "Securities Act"). "Liquidity Capitalization" means all shares of the Company's capital stock (on an as-converted basis) issued and outstanding, assuming exercise or conversion of all outstanding vested and unvested options, warrants and other convertible securities, but excluding (i) all shares of the Common Stock reserved and available for future grant under any equity incentive or similar plan of the Company; (ii) this instrument, (iii) all other SAFEs, and (iv) convertible promissory notes. "Liquidity Event" means a Change of Control or an Initial Public Offering. "Liquidity Price" means the price per share equal to the quotient obtained by dividing (i) the Valuation Cap by (ii) the Liquidity Capitalization as of immediately prior to the Liquidity Event. "Pro Rata Rights Agreement" means a written agreement between the Company and the Investor (and holders of other SAFEs, as appropriate) giving the Investor a right to purchase its pro rata share of private placements of securities by the Company occurring after the Equity Financing, subject to customary exceptions. Pro rata for purposes of the Pro Rata Rights Agreement will be calculated based on the ratio of (a) the number of shares of capital stock of the Company owned by the Investor immediately prior to the issuance of the securities to (b) the total number of shares of outstanding capital stock of the Company on a fully diluted basis, calculated as of immediately prior to the issuance of the securities. "SAFE" means an instrument containing a future right to the Company's capital stock, similar in form and content to this instrument, purchased by investors for the purpose of funding the Company's business operations. "SAFE Preferred Stock" means the shares of a series of the Company's preferred stock issued to the Investor in an Equity Financing, which will have the identical rights, privileges, preferences and restrictions as the shares of Standard Preferred Stock, other than with respect to the per share liquidation preference, which will equal the SAFE Price or the Discount Price (as applicable), as well as price-based anti-dilution protection and dividend rights, which will be based on such SAFE Price or the Discount Price (as applicable). "SAFE Price" means the price per share equal to the quotient obtained by dividing (i) the Valuation Cap by (ii) either (A) the Company Capitalization as of immediately prior to the Equity Financing or (B) the capitalization of the Company used to calculate the price per share of the Standard Preferred Stock, whichever calculation results in a lower price. "Standard Preferred Stock" means the shares of a series of the Company's preferred stock issued to the investors investing new money in the Company in connection with the initial closing of the Equity Financing. EQUITY FINANCING EVENT If there is an Equity Financing Event before the expiration or termination of this instrument, the Company will automatically issue to the Investor either: a number of shares of Standard Preferred Stock sold in the Equity Financing equal to the Purchase Amount divided by the price per share of the Standard Preferred Stock, if the pre-money valuation is less than or equal to the Valuation Cap; or

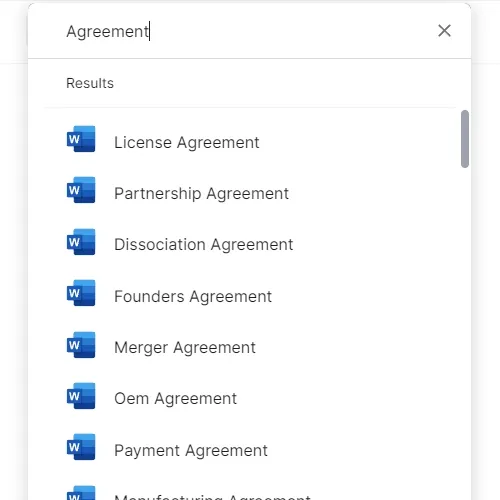

Easily Create Any Business Document You Need in Minutes.

Download or open template

Access over 3,000+ business and legal templates for any business task, project or initiative.

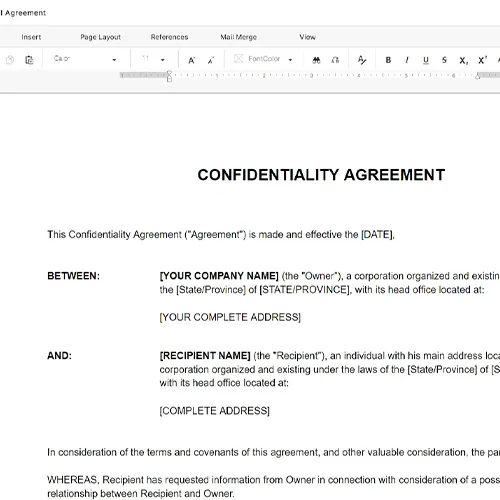

Edit and fill in the blanks

Customize your ready-made business document template and save it in the cloud.

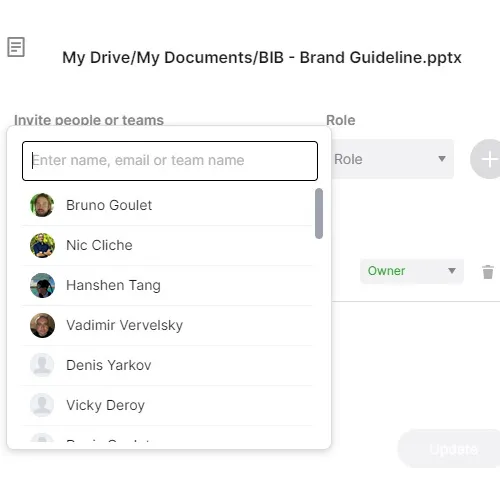

Save, Share, Export, or Sign

Share your files and folders with your team. Create a space of seamless collaboration.