Payment Agreement Template

Establishing Financial Responsibilities With a Payment Contract

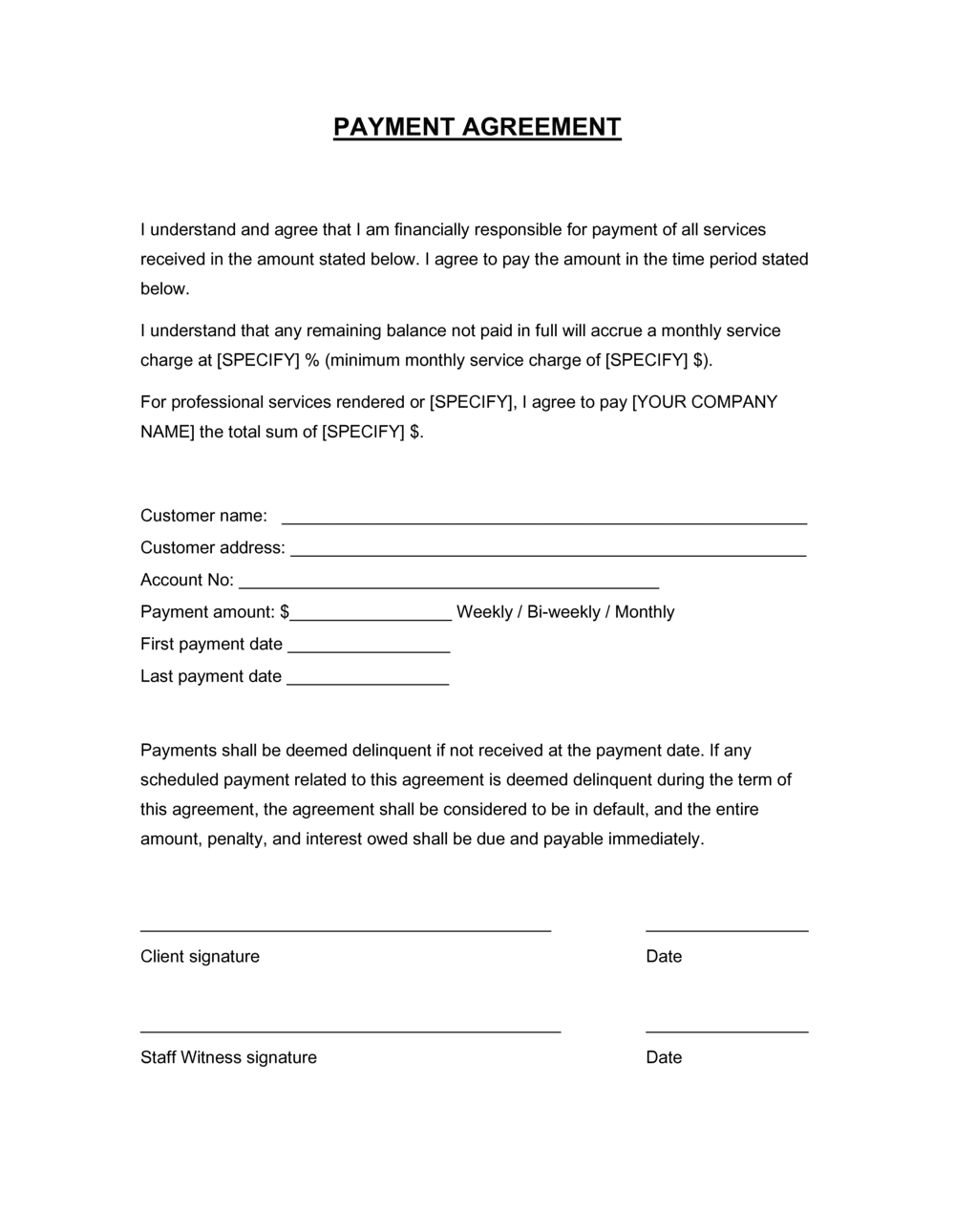

The Payment Agreement document outlines the terms for one party to compensate another for goods or services provided, or loan repayments made. This document clarifies details of the transaction like the sum owed and payment schedule to prevent misunderstandings or disagreements. This document is intended to promote transparency and trust between parties involved in any transaction.

A Payment Agreement template can assist individuals and companies in defining their responsibilities and commitments.

- Involved Parties - Involved Parties refer to the individuals or entities listed by name and contact information indicating their roles and responsibilities under the agreement.

- Payment Terms - Specifies the payment amount and details like payment frequency, due dates and payment methods.

- **Interest and Penalties: Outlines any interest fees or penalties for missed payments to ensure responsibility.

- Payment Schedule - Establishes a timeline for payment, outlining installment amounts and the duration of the agreement.

- Purpose of Payment - Clearly states the intention behind making the payment to ensure both parties are on the same page.

- Default and Remedies - This section outlines the actions to be taken should one party fail to meet the terms of the agreement, including actions and the resolution process.

- Signatures and Dates - This section includes spaces for both parties to sign and date the agreement, confirming acceptance.

Supporting Documents for Structuring a Payment Agreement

To ensure a comprehensive Payment Agreement, integrating documents is recommended:

- Invoice - A detailed document listing the goods or services provided forming the basis of the payment arrangement.

- Loan Agreement - A loan agreement outlines the specifics of a loan, including the loan amount, interest rate and repayment schedule.

- Promissory Note - A promissory note is a legal commitment to return a set amount of money within a designated time frame.

- Receipts - Proof of purchases, such as receipts, are essential for tracking and verifying transactions that have been completed and paid for.

Advantages of Utilizing a Comprehensive Payment Contract Template

Using a template for drafting a Payment Agreement offers several advantages:

- Clarity and Transparency - Clearly outlines financial responsibilities, minimizing misunderstandings.

- Accountability - Establishes a framework for monitoring payments to ensure compliance with agreed-upon terms.

- Legal Compliance - Helps align the agreement with applicable laws, reducing potential conflicts.

- Minimizing the risk - Reducing the likelihood of not getting paid or defaulting by establishing penalties for contract violations.

A Payment Agreement is crucial to facilitating effective dealings among involved parties. It aids in articulating the payment conditions to avoid confusion, encourages responsibility while nurturing a culture of trust and openness in interactions, and acts as a measure by ensuring that both sides share a comprehension of their monetary commitments, resulting in the enhancement of the business relationship.

Revised in September 2024

Reviewed on

Establishing Financial Responsibilities With a Payment Contract

The Payment Agreement document outlines the terms for one party to compensate another for goods or services provided, or loan repayments made. This document clarifies details of the transaction like the sum owed and payment schedule to prevent misunderstandings or disagreements. This document is intended to promote transparency and trust between parties involved in any transaction.

A Payment Agreement template can assist individuals and companies in defining their responsibilities and commitments.

- Involved Parties - Involved Parties refer to the individuals or entities listed by name and contact information indicating their roles and responsibilities under the agreement.

- Payment Terms - Specifies the payment amount and details like payment frequency, due dates and payment methods.

- **Interest and Penalties: Outlines any interest fees or penalties for missed payments to ensure responsibility.

- Payment Schedule - Establishes a timeline for payment, outlining installment amounts and the duration of the agreement.

- Purpose of Payment - Clearly states the intention behind making the payment to ensure both parties are on the same page.

- Default and Remedies - This section outlines the actions to be taken should one party fail to meet the terms of the agreement, including actions and the resolution process.

- Signatures and Dates - This section includes spaces for both parties to sign and date the agreement, confirming acceptance.

Supporting Documents for Structuring a Payment Agreement

To ensure a comprehensive Payment Agreement, integrating documents is recommended:

- Invoice - A detailed document listing the goods or services provided forming the basis of the payment arrangement.

- Loan Agreement - A loan agreement outlines the specifics of a loan, including the loan amount, interest rate and repayment schedule.

- Promissory Note - A promissory note is a legal commitment to return a set amount of money within a designated time frame.

- Receipts - Proof of purchases, such as receipts, are essential for tracking and verifying transactions that have been completed and paid for.

Advantages of Utilizing a Comprehensive Payment Contract Template

Using a template for drafting a Payment Agreement offers several advantages:

- Clarity and Transparency - Clearly outlines financial responsibilities, minimizing misunderstandings.

- Accountability - Establishes a framework for monitoring payments to ensure compliance with agreed-upon terms.

- Legal Compliance - Helps align the agreement with applicable laws, reducing potential conflicts.

- Minimizing the risk - Reducing the likelihood of not getting paid or defaulting by establishing penalties for contract violations.

A Payment Agreement is crucial to facilitating effective dealings among involved parties. It aids in articulating the payment conditions to avoid confusion, encourages responsibility while nurturing a culture of trust and openness in interactions, and acts as a measure by ensuring that both sides share a comprehension of their monetary commitments, resulting in the enhancement of the business relationship.

Revised in September 2024

Easily Create Any Business Document You Need in Minutes.

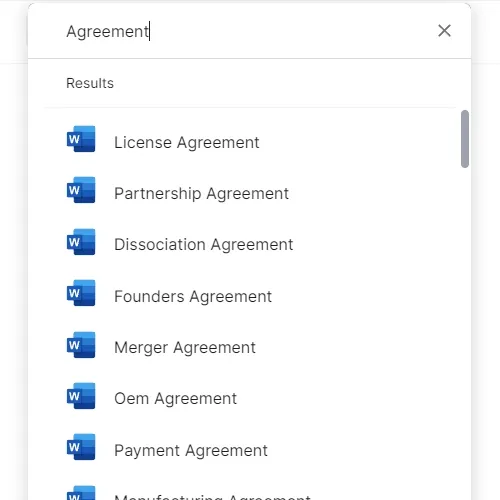

Download or open template

Access over 3,000+ business and legal templates for any business task, project or initiative.

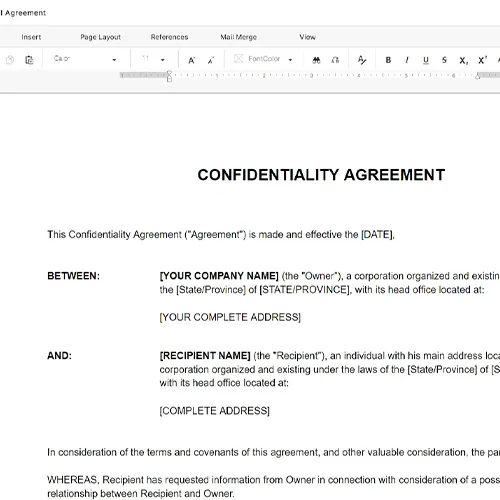

Edit and fill in the blanks

Customize your ready-made business document template and save it in the cloud.

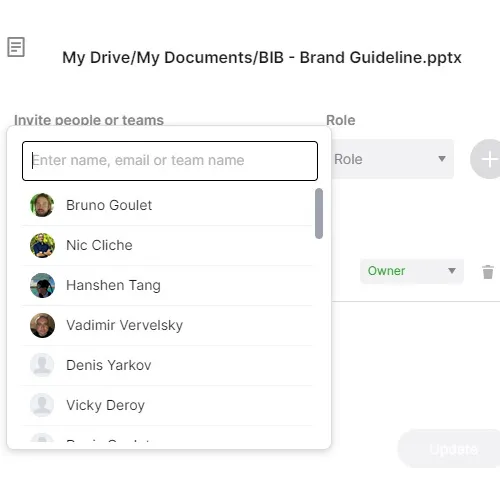

Save, Share, Export, or Sign

Share your files and folders with your team. Create a space of seamless collaboration.