4 Types Of Risk Management Strategies

Document content

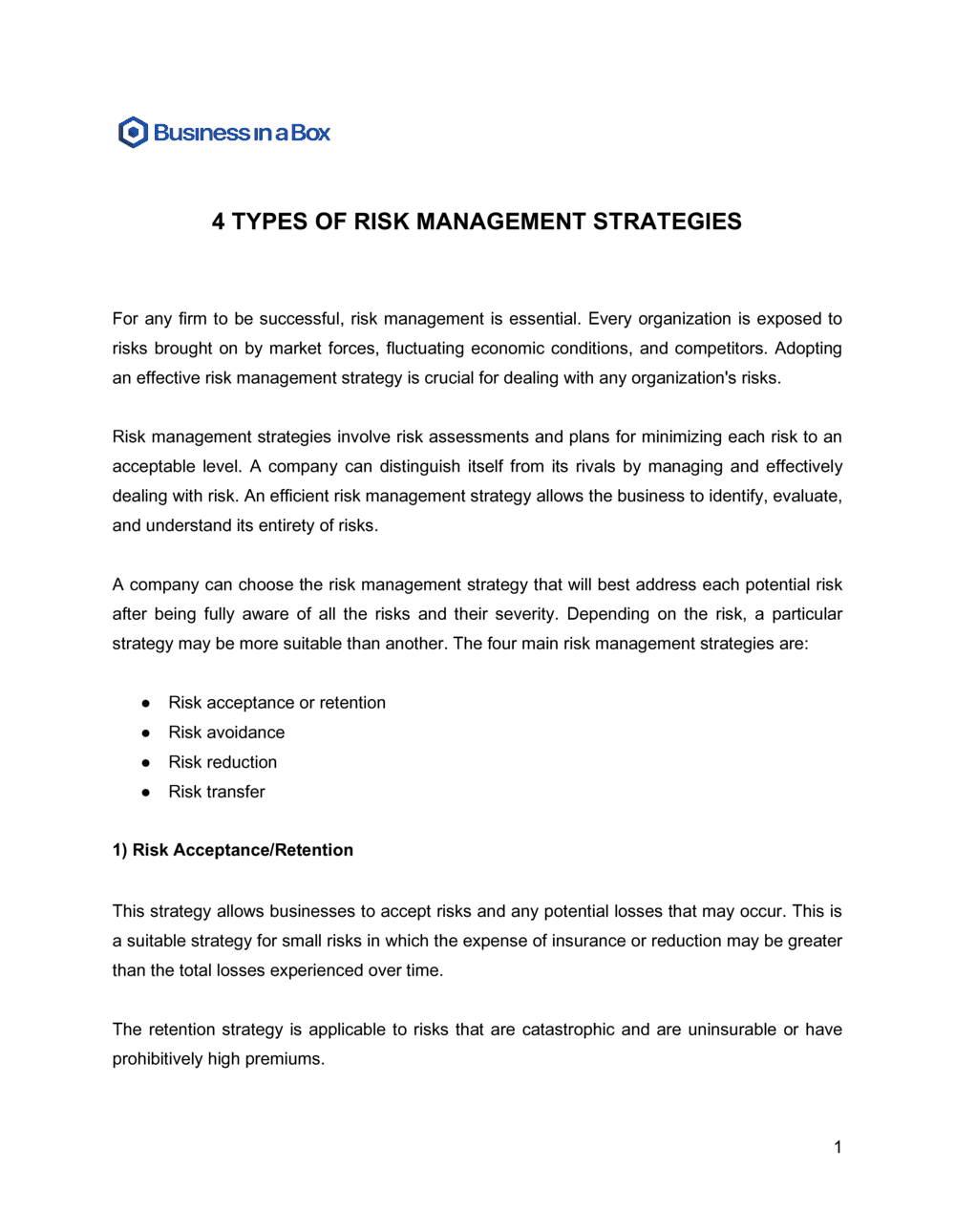

This 4 types of risk management strategies template has 3 pages and is a MS Word file type listed under our business plan kit documents.

Sample of our 4 types of risk management strategies template:

4 TYPES OF RISK MANAGEMENT STRATEGIES For any firm to be successful, risk management is essential. Every organization is exposed to risks brought on by market forces, fluctuating economic conditions, and competitors. Adopting an effective risk management strategy is crucial for dealing with any organization's risks. Risk management strategies involve risk assessments and plans for minimizing each risk to an acceptable level. A company can distinguish itself from its rivals by managing and effectively dealing with risk. An efficient risk management strategy allows the business to identify, evaluate, and understand its entirety of risks. A company can choose the risk management strategy that will best address each potential risk after being fully aware of all the risks and their severity. Depending on the risk, a particular strategy may be more suitable than another. The four main risk management strategies are: Risk acceptance or retention Risk avoidance Risk reduction Risk transfer 1) Risk Acceptance/Retention This strategy allows businesses to accept risks and any potential losses that may occur. This is a suitable strategy for small risks in which the expense of insurance or reduction may be greater than the total losses experienced over time. The retention strategy is applicable to risks that are catastrophic and are uninsurable or have prohibitively high premiums. However, if risk events happen frequently, business disruption and the expenses associated with managing them would almost certainly increase. A business must evaluate risk retention options along with other potential mitigation techniques to select an excellent long-term approach. 2) Risk Avoidance Risk avoidance is a strategy in which the company refrains from engaging in any actions likely to cause risk. When a risk may potentially cause the business significant or irreversible harm, risk avoidance may be the best strategy. A risk-avoidance strategy could involve altering how a product is produced or forgoing a particular investment. For long-term risks, the avoidance approach may not be sufficient. The organization should reevaluate this response and seek other management tactics if avoidance increases expenses or results in other issues. It is essential to determine the risk-avoidance strategy and how it might help the business. 3) Risk Reduction A risk-reduction strategy might be the best option if an organization cannot eliminate a risk. Risk reduction involves taking steps to reduce the likelihood and consequences of the risk occurring. The goal is to lower the risk to a manageable level, also referred to as a residual risk. Most businesses should strive to minimize risk whenever it is possible and profitable. Organizations can lower risk by outsourcing tasks to people with greater skill sets or who can successfully manage risks

Reviewed on

Document content

This 4 types of risk management strategies template has 3 pages and is a MS Word file type listed under our business plan kit documents.

Sample of our 4 types of risk management strategies template:

4 TYPES OF RISK MANAGEMENT STRATEGIES For any firm to be successful, risk management is essential. Every organization is exposed to risks brought on by market forces, fluctuating economic conditions, and competitors. Adopting an effective risk management strategy is crucial for dealing with any organization's risks. Risk management strategies involve risk assessments and plans for minimizing each risk to an acceptable level. A company can distinguish itself from its rivals by managing and effectively dealing with risk. An efficient risk management strategy allows the business to identify, evaluate, and understand its entirety of risks. A company can choose the risk management strategy that will best address each potential risk after being fully aware of all the risks and their severity. Depending on the risk, a particular strategy may be more suitable than another. The four main risk management strategies are: Risk acceptance or retention Risk avoidance Risk reduction Risk transfer 1) Risk Acceptance/Retention This strategy allows businesses to accept risks and any potential losses that may occur. This is a suitable strategy for small risks in which the expense of insurance or reduction may be greater than the total losses experienced over time. The retention strategy is applicable to risks that are catastrophic and are uninsurable or have prohibitively high premiums. However, if risk events happen frequently, business disruption and the expenses associated with managing them would almost certainly increase. A business must evaluate risk retention options along with other potential mitigation techniques to select an excellent long-term approach. 2) Risk Avoidance Risk avoidance is a strategy in which the company refrains from engaging in any actions likely to cause risk. When a risk may potentially cause the business significant or irreversible harm, risk avoidance may be the best strategy. A risk-avoidance strategy could involve altering how a product is produced or forgoing a particular investment. For long-term risks, the avoidance approach may not be sufficient. The organization should reevaluate this response and seek other management tactics if avoidance increases expenses or results in other issues. It is essential to determine the risk-avoidance strategy and how it might help the business. 3) Risk Reduction A risk-reduction strategy might be the best option if an organization cannot eliminate a risk. Risk reduction involves taking steps to reduce the likelihood and consequences of the risk occurring. The goal is to lower the risk to a manageable level, also referred to as a residual risk. Most businesses should strive to minimize risk whenever it is possible and profitable. Organizations can lower risk by outsourcing tasks to people with greater skill sets or who can successfully manage risks

Easily Create Any Business Document You Need in Minutes.

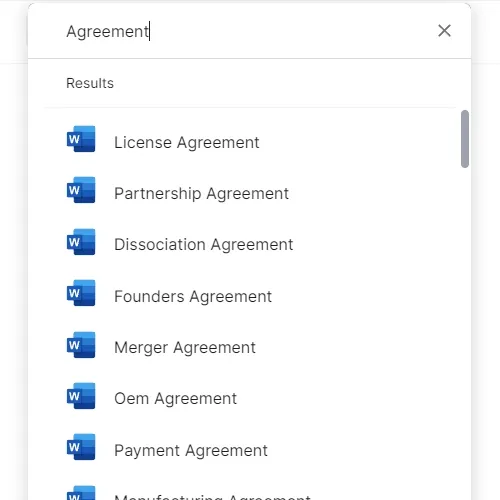

Download or open template

Access over 3,000+ business and legal templates for any business task, project or initiative.

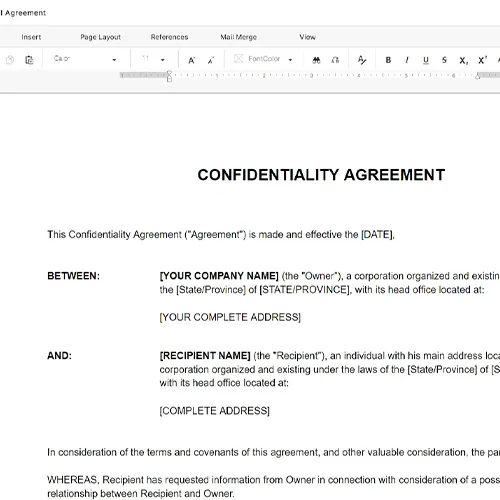

Edit and fill in the blanks

Customize your ready-made business document template and save it in the cloud.

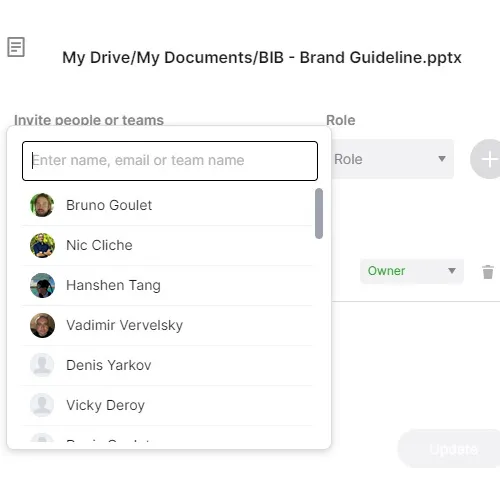

Save, Share, Export, or Sign

Share your files and folders with your team. Create a space of seamless collaboration.