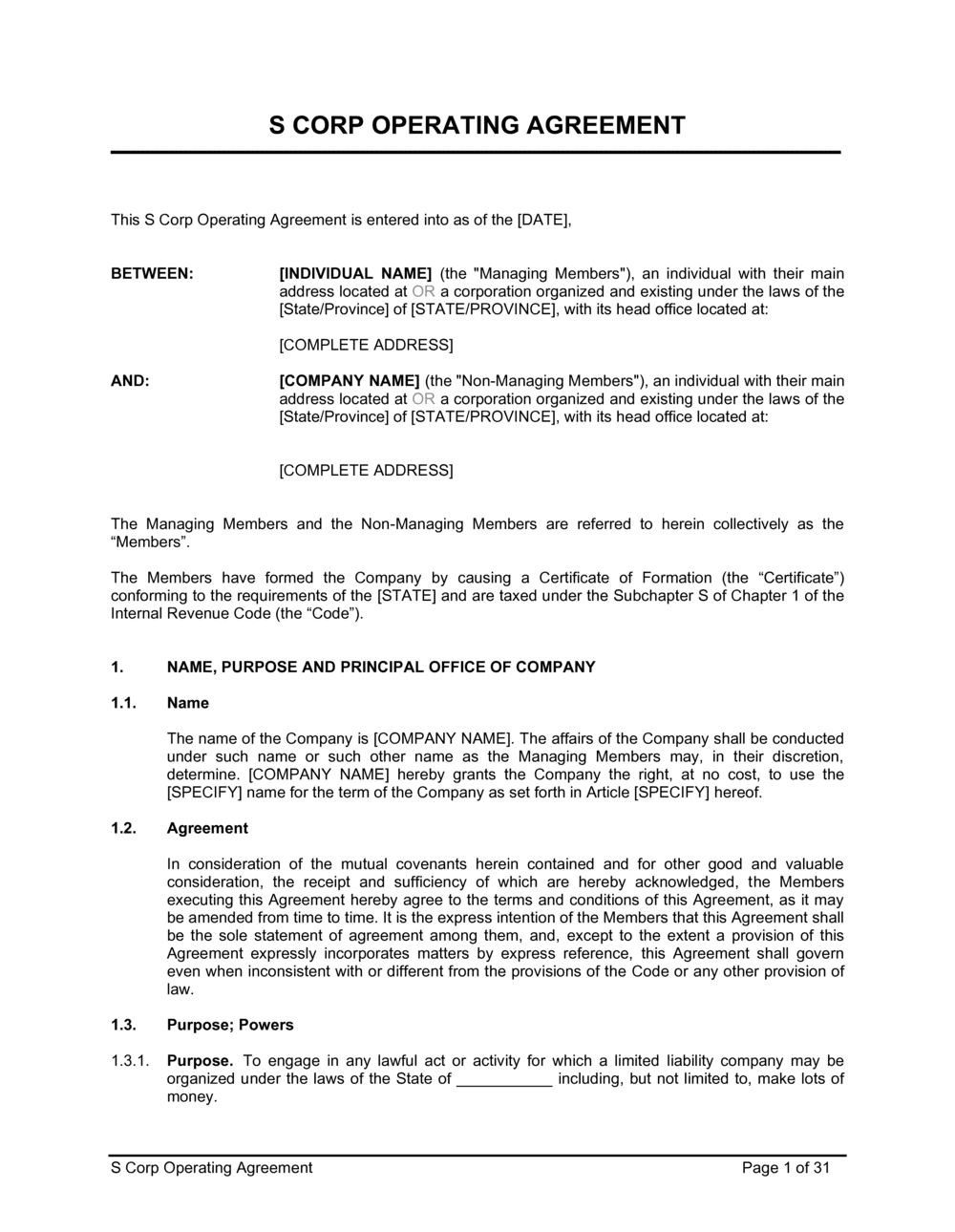

S Corp Operating Agreement Template

Enhancing Corporate Governance with an S Corporation Operating Agreement

In the realm of corporate structures, an S Corporation offers unique advantages, particularly regarding taxation and shareholder flexibility. To maximize these benefits, an S Corporation Operating Agreement is crucial. This key document formalizes the operational framework, outlining the governance, financial, and managerial protocols that guide the corporation's activities. It ensures that all parties understand their roles and obligations, fostering a structured and efficient corporate environment.

An S Corporation Operating Agreement is essential for defining the parameters of the corporation's operations, including shareholder rights, management responsibilities, profit distribution, and procedures for resolving disputes. It provides a legal framework supporting transparent and effective corporate governance, ensuring compliance with federal and state regulations.

What is an S Corporation Operating Agreement Template?

An S Corporation Operating Agreement template is a comprehensive guide for drafting detailed agreements that govern the operation of an S Corporation. It ensures that all critical elements are addressed, including shareholder roles, voting rights, profit allocation, and dispute resolution mechanisms. Utilizing a template streamlines the creation process, ensuring consistency and thoroughness while allowing for customization to fit the specific needs and requirements of the corporation.

Key Elements of an S Corporation Operating Agreement

A robust S Corporation Operating Agreement should thoroughly address the following key elements:

- Identification of Parties - Clearly identifies the corporation and its shareholders, including their respective roles and ownership interests.

- Purpose and Scope - This defines the corporation's purpose, including its specific goals, objectives, and scope of activities.

- Shareholder Contributions - Details the initial capital contributions of each shareholder, whether in the form of cash, assets, or services, and outlines procedures for additional contributions.

- Management Structure - Outlines the governance structure, including the roles of officers and directors, and the decision-making processes.

- Voting Rights - Specifies shareholders' voting rights, including the procedures for casting votes and making major corporate decisions.

- Profit and Loss Distribution - Details how profits and losses will be allocated among shareholders, typically in proportion to their ownership interests.

- Meetings and Quorums - Establishes the procedures for holding shareholder and board meetings, including quorum requirements and voting thresholds.

- Transfer of Shares - Outlines the procedures for transferring shares, including any restrictions on share transfers, to ensure compliance with S Corporation requirements.

- Dispute Resolution - Includes provisions for resolving disputes among shareholders, typically through mediation or arbitration, to avoid litigation and maintain a cooperative relationship.

- Dissolution - Defines the conditions under which the corporation can be dissolved, including procedures for winding down and distributing remaining assets.

Supporting Documents for Structuring an S Corporation Operating Agreement

To enhance the functionality and comprehensiveness of an S Corporation Operating Agreement, integrating the following supporting documents is advisable:

- Shareholder Agreement - Provides additional details on the rights and obligations of shareholders, complementing the operating agreement.

- General Bylaws - Establishes the internal rules and procedures for the corporation’s governance, aligning with the operating agreement.

- Meeting Minutes - Records the discussions and decisions made during shareholder and board meetings, ensuring transparency and accountability.

- Non-Disclosure Agreement (NDA) - Protects sensitive corporate information exchanged among shareholders and management.

Why Employ a Detailed Template for an S Corporation Operating Agreement?

Utilizing a detailed template for drafting your S Corporation Operating Agreement offers significant benefits:

- Clarity and Precision - Ensures that all necessary information is clearly presented, reducing the likelihood of misunderstandings or miscommunications.

- Professionalism - Projects a professional image, demonstrating to stakeholders that the corporation is well-governed and that operations are conducted systematically and transparently.

- Efficiency - Streamlines the agreement preparation process, saving time and resources that can be better allocated to strategic initiatives.

- Compliance - Ensures that the agreement adheres to legal and regulatory requirements, reducing the risk of non-compliance and potential legal issues.

- Risk Mitigation - Reduces potential legal disputes by clearly defining roles, responsibilities, and profit-sharing agreements.

Adopting a comprehensive S Corporation Operating Agreement is essential for effective corporate governance. It provides a clear, enforceable framework that aligns shareholders and management with their mutual goals, ensuring that the corporation operates smoothly and complies with legal requirements. This fundamental document facilitates operational efficacy and solidifies the commitment to strategic growth and corporate integrity.

Updated in May 2024

Reviewed on

Enhancing Corporate Governance with an S Corporation Operating Agreement

In the realm of corporate structures, an S Corporation offers unique advantages, particularly regarding taxation and shareholder flexibility. To maximize these benefits, an S Corporation Operating Agreement is crucial. This key document formalizes the operational framework, outlining the governance, financial, and managerial protocols that guide the corporation's activities. It ensures that all parties understand their roles and obligations, fostering a structured and efficient corporate environment.

An S Corporation Operating Agreement is essential for defining the parameters of the corporation's operations, including shareholder rights, management responsibilities, profit distribution, and procedures for resolving disputes. It provides a legal framework supporting transparent and effective corporate governance, ensuring compliance with federal and state regulations.

What is an S Corporation Operating Agreement Template?

An S Corporation Operating Agreement template is a comprehensive guide for drafting detailed agreements that govern the operation of an S Corporation. It ensures that all critical elements are addressed, including shareholder roles, voting rights, profit allocation, and dispute resolution mechanisms. Utilizing a template streamlines the creation process, ensuring consistency and thoroughness while allowing for customization to fit the specific needs and requirements of the corporation.

Key Elements of an S Corporation Operating Agreement

A robust S Corporation Operating Agreement should thoroughly address the following key elements:

- Identification of Parties - Clearly identifies the corporation and its shareholders, including their respective roles and ownership interests.

- Purpose and Scope - This defines the corporation's purpose, including its specific goals, objectives, and scope of activities.

- Shareholder Contributions - Details the initial capital contributions of each shareholder, whether in the form of cash, assets, or services, and outlines procedures for additional contributions.

- Management Structure - Outlines the governance structure, including the roles of officers and directors, and the decision-making processes.

- Voting Rights - Specifies shareholders' voting rights, including the procedures for casting votes and making major corporate decisions.

- Profit and Loss Distribution - Details how profits and losses will be allocated among shareholders, typically in proportion to their ownership interests.

- Meetings and Quorums - Establishes the procedures for holding shareholder and board meetings, including quorum requirements and voting thresholds.

- Transfer of Shares - Outlines the procedures for transferring shares, including any restrictions on share transfers, to ensure compliance with S Corporation requirements.

- Dispute Resolution - Includes provisions for resolving disputes among shareholders, typically through mediation or arbitration, to avoid litigation and maintain a cooperative relationship.

- Dissolution - Defines the conditions under which the corporation can be dissolved, including procedures for winding down and distributing remaining assets.

Supporting Documents for Structuring an S Corporation Operating Agreement

To enhance the functionality and comprehensiveness of an S Corporation Operating Agreement, integrating the following supporting documents is advisable:

- Shareholder Agreement - Provides additional details on the rights and obligations of shareholders, complementing the operating agreement.

- General Bylaws - Establishes the internal rules and procedures for the corporation’s governance, aligning with the operating agreement.

- Meeting Minutes - Records the discussions and decisions made during shareholder and board meetings, ensuring transparency and accountability.

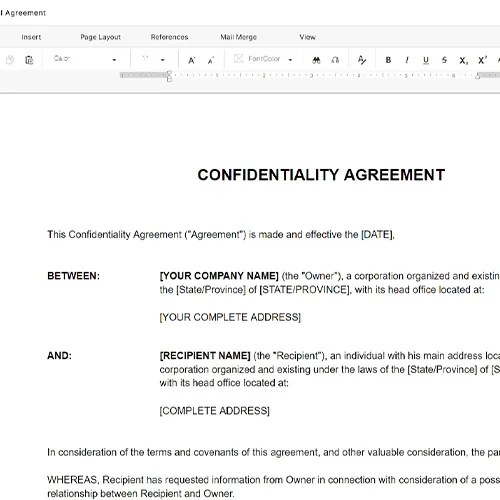

- Non-Disclosure Agreement (NDA) - Protects sensitive corporate information exchanged among shareholders and management.

Why Employ a Detailed Template for an S Corporation Operating Agreement?

Utilizing a detailed template for drafting your S Corporation Operating Agreement offers significant benefits:

- Clarity and Precision - Ensures that all necessary information is clearly presented, reducing the likelihood of misunderstandings or miscommunications.

- Professionalism - Projects a professional image, demonstrating to stakeholders that the corporation is well-governed and that operations are conducted systematically and transparently.

- Efficiency - Streamlines the agreement preparation process, saving time and resources that can be better allocated to strategic initiatives.

- Compliance - Ensures that the agreement adheres to legal and regulatory requirements, reducing the risk of non-compliance and potential legal issues.

- Risk Mitigation - Reduces potential legal disputes by clearly defining roles, responsibilities, and profit-sharing agreements.

Adopting a comprehensive S Corporation Operating Agreement is essential for effective corporate governance. It provides a clear, enforceable framework that aligns shareholders and management with their mutual goals, ensuring that the corporation operates smoothly and complies with legal requirements. This fundamental document facilitates operational efficacy and solidifies the commitment to strategic growth and corporate integrity.

Updated in May 2024

Easily Create Any Business Document You Need in Minutes.

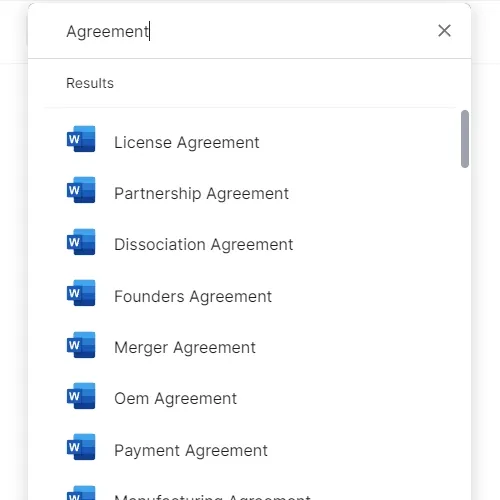

Download or open template

Access over 3,000+ business and legal templates for any business task, project or initiative.

Edit and fill in the blanks

Customize your ready-made business document template and save it in the cloud.

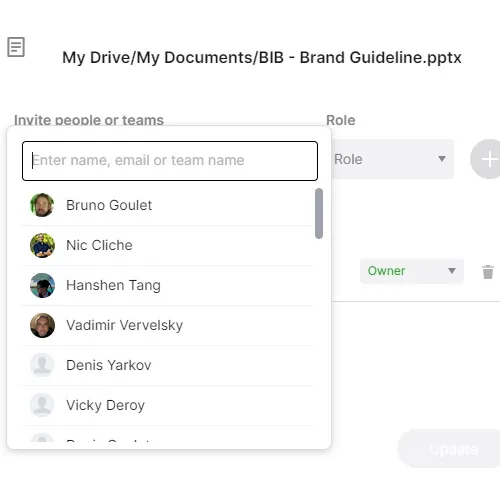

Save, Share, Export, or Sign

Share your files and folders with your team. Create a space of seamless collaboration.